I was intrigued by the recent Barron’s cover story on robo-advice. The Barron’s article described example portfolios for Betterment, Charles Schwab, Vanguard Personal Advisor Services, and Wealthfront. As I mentioned in my last post, robo-advisors are power-users of indexing and ETFs. So I thought that it would be interesting to compare and contrast some of the ETF holdings of two of these robo-advisors, with my assumption being that the portfolios that these robos would construct will be bare-bones, no frills core portfolios. Emerging and mass affluent clients currently are underserved with regard to strategic asset allocations.

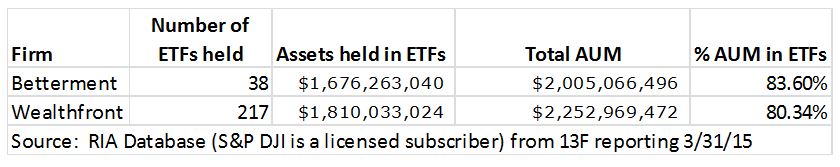

The Barron’s article had me expecting to find that the RIAs Betterment and Wealthfront held 10-12 ETFs for their clients. Not the case. I was surprised by the breadth of their ETF holdings and by the percentage of assets which they have committed to index-trackers.

Cerulli data from EOY 2014 indicates that RIAs, on average, have approximately 80% of client assets in ETFs. So these two robo-advisors are at roughly 400% of the average.

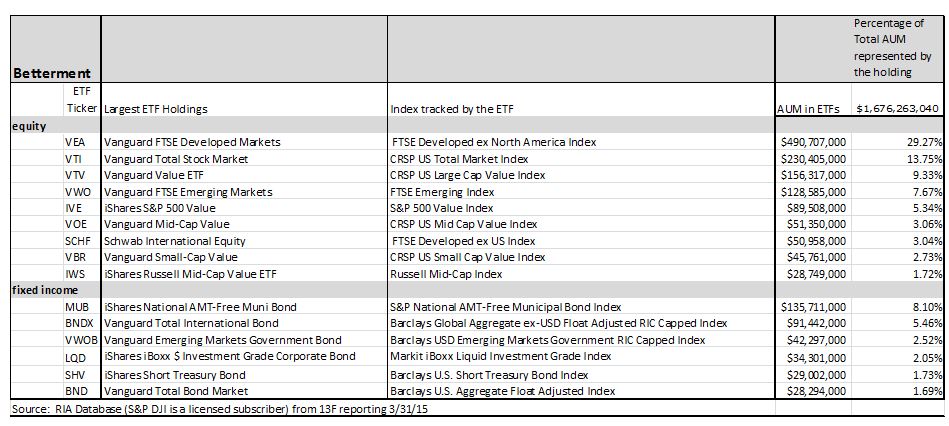

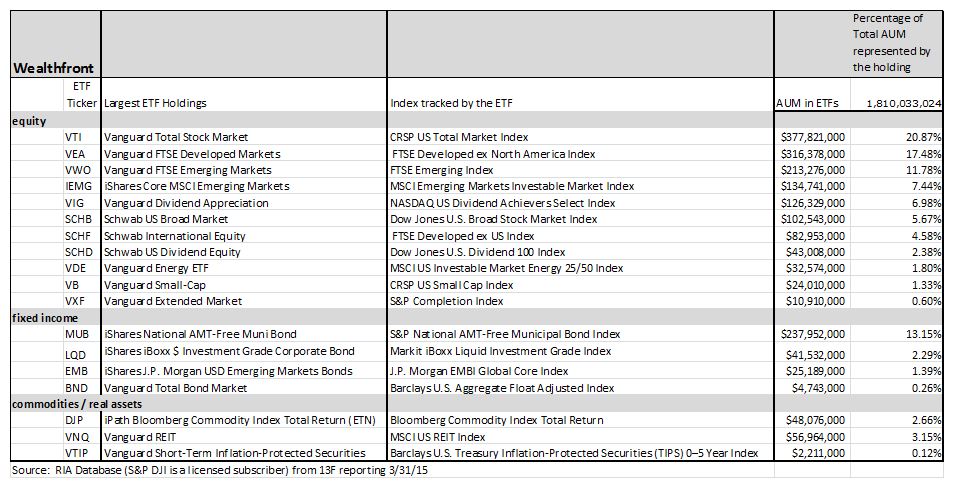

Next, I wanted to see how these two robo-advisors are using indexing and ETFs to create core portfolios. To be clear, I can only see the aggregate of their holdings, not individual client accounts. Based on their average client size ($20,192 for Betterment and $75,636 for Wealthfront) and the amount of AUM in certain ETFs, I can draw some conclusions about the ETFs which are most commonly recommended by these two robo-advisors:

First, the ETF holdings of both robo-advisors do show a focus on core building blocks such as total market solutions and capturing entire asset classes in a single ETF. Such an approach is a simple and inexpensive way to deliver market exposure. Both robo-advisors show a willingness to use an emerging markets debt ETF for exposure to that asset class. And interestingly, both choose the same ETF for exposure to municipal bonds. The large AUM which each robo-advisors hold in a muni bond ETF reflect widespread use of indexing as the method to deliver diversified and national exposure to munis. Key differences are seen in some of the ETFs used, which may reflect different trading costs due to custodial relationships. Wealthfront also shows Commodity, TIP, and REIT holdings at a higher level than Betterment. Wealthfront, in the large number of different ETFs that they hold for clients, also demonstrates difference in breadth of choice or perhaps in their willingness to customize portfolios for clients.

How these two robo-advisors have defined core portfolios and strategic asset allocation with ETFs is not only interesting now, but may serve as an interesting source of data and insights for the future. Structurally and philosophically, I assume from what I have read that the robo-advisors will not encourage frequent trading and will educate investors to stick with their algorithmically-determined investment strategy. Will the robo-advisors eventually publish “cohort” results over time and over business cycles? If so, it will be interesting to see how effective these strategic asset allocation portfolios are in wealth accumulation and preventing the type of actual investor results which have been documented in years of DALBAR Quantitative Analysis of Investor Behavior studies.

The posts on this blog are opinions, not advice. Please read our Disclaimers.