This is the second blog in a series on the evolution of Australia’s tax-aware investment management (TAIM) landscape.

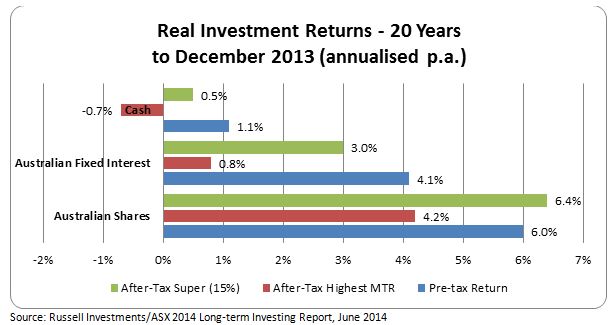

One historical record of the impact of taxes on returns in Australia is the annual Russell Investments/Australian Securities Exchange (ASX) Long-term Investing Report, which measures pre- and post-tax returns for various asset classes over 20-year periods. The returns for a selection of asset classes from the most recent report are depicted below:

The chart above shows the annualised inflation-adjusted index returns for Australian shares, fixed interest, and cash on a pre-tax basis, together with how those returns changed with the impact of taxes for two different types of taxpayers; superannuation funds (in accumulation mode) and an individual on the highest marginal tax rate(MTR).

The data indicates that Australian shares returned 6% p.a., after inflation, from December 1993 –December 2013, significantly ahead of Australian fixed interest at 4.1% p.a., and cash at 1.1% p.a. Once taxes are incorporated however, things start to look markedly different. An individual on the highest MTR had 1.8% p.a. removed from the pre-tax return, while a super fund received a tax-derived 0.4% p.a. boost to the index return for the entire 20-year period.

Fixed interest investors received not the 4.1% p.a. the market delivered, but either 0.8% p.a. or 3% p.a., depending on their tax status. As for cash investors, the 1.1% p.a. market return was either halved or actually turned negative due to the tax effect.

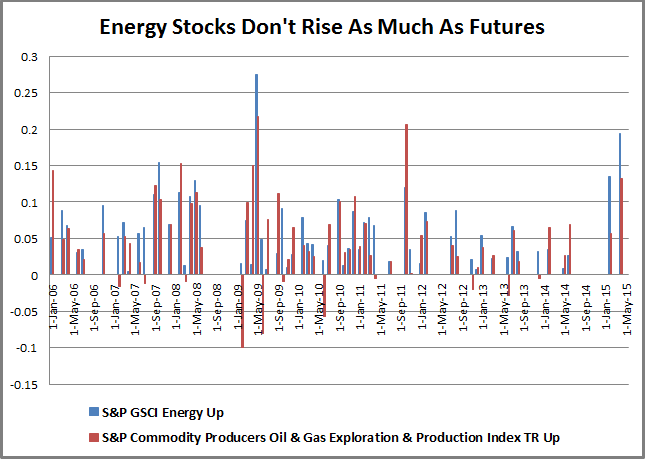

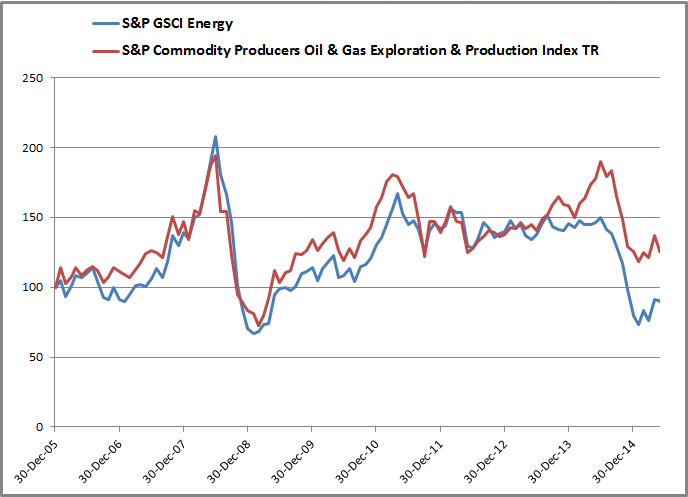

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices