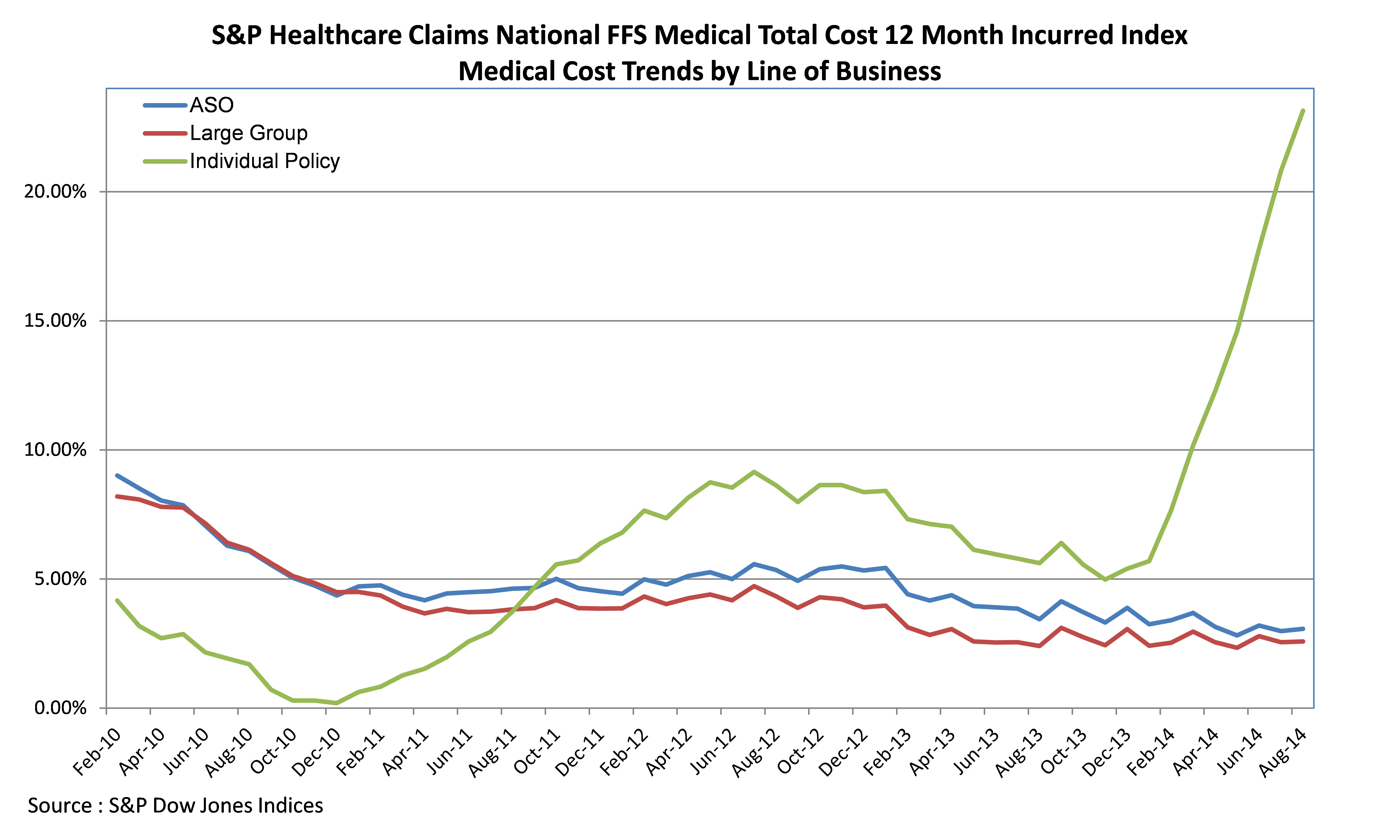

With the start of the second annual enrollment under the Affordable Care Act (ACA), there is high interest regarding the impact of the ACA on healthcare cost trends. The S&P Healthcare Claims Indices provide an accurate and up to date source of information available in the market regarding healthcare cost trends. The updates released in October 2014 are a measure for evaluating the impact of the ACA rules on healthcare trends.

The graph below shows the actual 12-month year/year healthcare cost trends for commercial medical insurance plans, with trends shown separately for:

- ASO (Self Funded) Plans – these plans are typically offered by large employers

- Insured Group Plans – insurance plans provided by employers with more than 50 employees

- Individual Plans – medical plans purchased by individuals (including the ACA exchanges)

A quick glance at the indices makes a couple of issues clear:

- For most employer-based medical plans, trends reached a low of 3% during late 2011 and have since increased between 4% – 6% annually.

- For individual plans, healthcare costs began trending upward in early 2011 (while employer costs were trending downward) rising to an annual increase between 6% – 8% by early 2012.

- With the implementation of the ACA rules eliminating pre-existing conditions, individual medical trends are increasing significantly. The most recent indexes show medical trends at 18% annually and the graph makes clear that the trend may go higher before the market stabilizes.

The S&P Indices highlight a couple of critical realities regarding healthcare costs. First, there is no single “trend rate” of healthcare costs – there are multiple factors impacting healthcare costs and good analysis should provide an understanding of how specific populations and types of healthcare services are changing. Second, healthcare costs can be significantly impacted by public policy changes and it may take years for these changes to be fully evident. In the meantime, having accurate and up to date information about healthcare cost changes will be critical to managing healthcare programs.

The posts on this blog are opinions, not advice. Please read our Disclaimers.