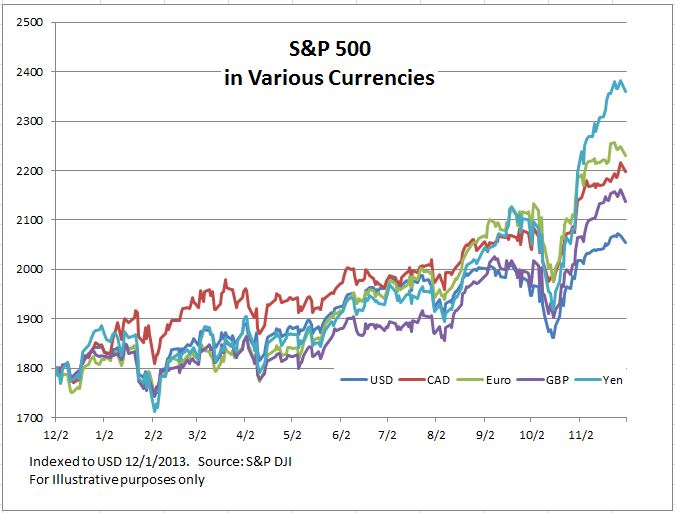

The US dollar has strengthened against most other currencies in recent months. Over the last year the dollar is up 5% against the British pound, 7% versus the Canadian dollar, 8% over the Australian dollar, 9% ahead of the euro and 16% against the yen. Movements this big shouldn’t be ignored – foreign investors with funds tracking the S&P 500 are doing much better than their domestic American counter parts while Americans in funds tracking some foreign indices are losing ground because of the dollar’s renewed strength. Further, if it seems some analysts following oil in other countries aren’t as excited as analysts in the US, the answer also is the dollar: Brent crude prices are down about 36% for dollar-based purchasers but only 24% for those based in yen.

The first chart compares the performance in the last 12 months of an investment tracking the S&P 500 for investors in various currencies. Tracking the S&P 500 in any of the other currencies than the dollar came out ahead.

The second chart shows how US dollar-based investors would have missed out on the recent surge in the S&P TOPIX 150 due to the yen’s weakness. The gains of the last month or two would have been lost in the translation from yen to dollars.

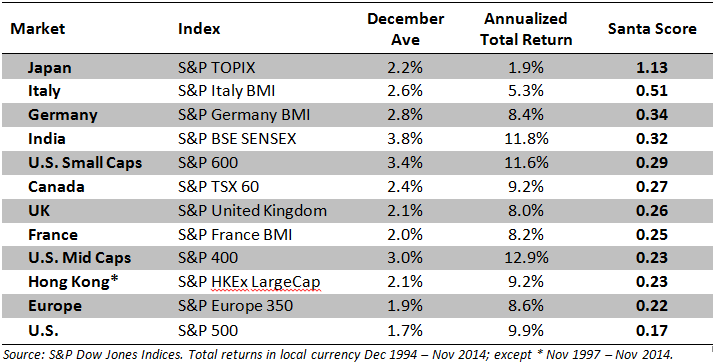

While investing outside the US is less attractive for many American-based investors as foreign currencies weaken, there is a benefit to investors in the US: the rising dollar makes American equities more attractive to the rest of the world and draws in investment funds which can drive up stocks prices here. The US markets now represent about 50% of the S&P Global BMI index series, the highest proportion in over 20 years – some of that is market gains and some is dollar gains.

The posts on this blog are opinions, not advice. Please read our Disclaimers.