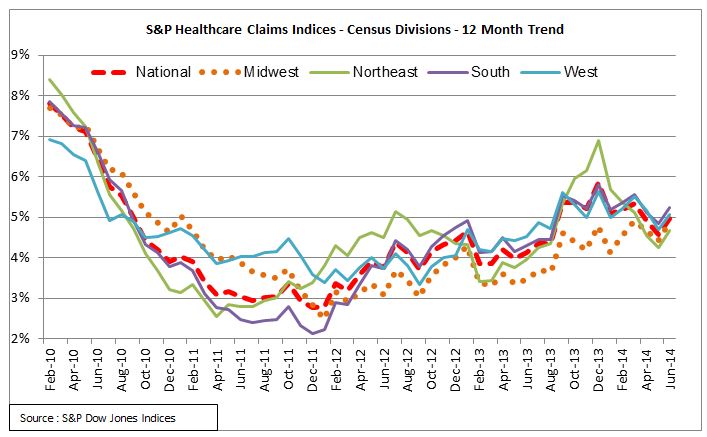

It’s an obvious point, but having access to accurate information is a critical part of being able to manage healthcare costs for the long term. Economic commentators often talk about the increase in healthcare costs (or trends) as a single figure, but, as the S&P Healthcare Claims Indices demonstrate, the truth is that healthcare trends can vary significantly across geographic regions, among the different types of healthcare services and across different segments of the insured population. While these different trends may generally move in consistent directions, there can be significant and often long term differences in the level of trend, ie the change in costs over time, between different components.

As an example, let’s look at the healthcare trends experienced by the four census divisions over the past five years, from early 2010 through mid- 2014 as measured by the S&P Healthcare Claims Indices. Census divisions are broad measures and as the graph indicates, the medical trends across all four regional divisions were roughly consistent during the period, but that average can mask important information about the level and the timing of the trends in each region. Consider the healthcare trends in the Midwest division, which were consistently higher than the national average during 2010 and 2011, but since early 2012 have been the lowest among the four regional divisions. During the second half of 2010, trends in the Midwest averaged 120 – 150 bps above the Northeast trends, but by mid-2012, those trends were reversed, and the Midwest region trends have since remained the lowest of any division.

These differences in regional trends over time point to the importance of looking past the average national trend to understand the specific trends that have the most impact. In particular, employers, health plans and healthcare provider systems need to establish their financial objectives using specific trend measures in order to manage their exposure to healthcare costs. Since the S&P Healthcare Claims Indices allow trends to be determined at the three-digit zip code level, it is possible to obtain and use tailored data on regional trends.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Like Preferreds, the difference in yield between the

Like Preferreds, the difference in yield between the