According to the Dow Jones Sukuk Index, the new issues that being captured in 2014 YTD totaled USD 11.8 billion, which represents 26% of the index exposure. While the total size of new issues this year is largely in-line with 2013, there are few interesting issuance trends that we observed.

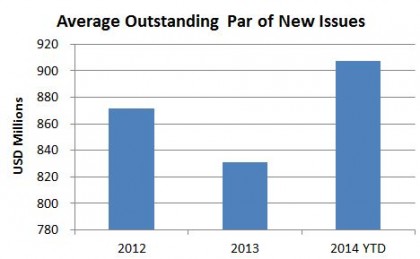

First, the average outstanding par of new issues tracked by the index, is on a rising trend and approaching USD 1 billion, as shown in Exhibit 1. This increase in deal size reflected a stronger investor demand. In fact, some returning issuers such as IDB Trust and Saudi Electric came back to the sukuk market with a larger deal size as well.

Exhibit 1: The Average Outstanding Par of New Issues in the Dow Jones Sukuk Index

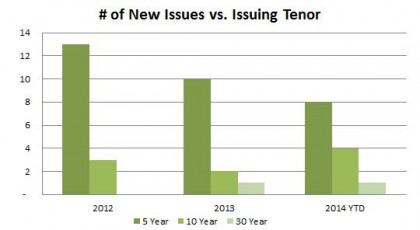

Second, the issuing tenor is extending into longer maturities. While historically sukuk was mostly five-year deals, more ten- and 30-year issuances are now tapping into the market, please see Exhibit 2. And if we look at the current overall index exposure, 32% of the total outstanding par amount was issued with the tenor of ten-year or above.

Exhibit 2: The Number of New Issues vs. Issuing Tenor in the Dow Jones Sukuk Index

Last but not least, we continue to see emergence of new issuers in the sukuk market. For example, HK Government and South Africa Sovereign both recently issued a five-year deal, while Goldman Sachs also raised a $500mio for a five-year sukuk in the same period.

Want to find out more information about the Dow Jones Sukuk Index? Please click here.

The posts on this blog are opinions, not advice. Please read our Disclaimers.