It all started with the Quran, the religious book of Islam, which guides all aspects of Muslim’s life. It is one of the fundamental sources of the Islamic (Shariah) law. The Shariah law has strict rules on finance; it forbids both interest “Riba” and uncertainty “Ghara”. It also prohibits a number of practices, such as any form of gambling “Qimar” and business that are related to alcohol, tobacco and immoral entertainment “Haram”.

Since interest-bearing bonds are not allowed, the emergence of Sukuk provided a new source of financing in this relatively restrictive environment. Sukuk are regarded as a highly innovative financial instrument in Islamic finance; it also facilitates rapid infrastructure funding and capital market development in the regions.

According to Auditing and Accounting Organization of Islamic Financial Institutions (AAOIFI), Sukuk are defined as “the certificates of equal value representing undivided shares in ownership of tangible assets, usufruct and services or in ownership of the asset of a particular project or special investment activity”. Unlike conventional bonds, Sukuk are based on a variety of contracts to create financial obligations and the returns to investors are considered as profit sharing, not interest!

Sukuk are becoming a popular investment asset class in both Islamic and non-Islamic communities. In addition to attractive yields, Sukuk are also perceived as higher quality assets since the Sukuk holders are in actual ownership of the tangible underlying assets. The primary market is active, for example, we had Abu Dhabi Investment Council and Republic of Turkey tapped onto the market in the past few weeks.

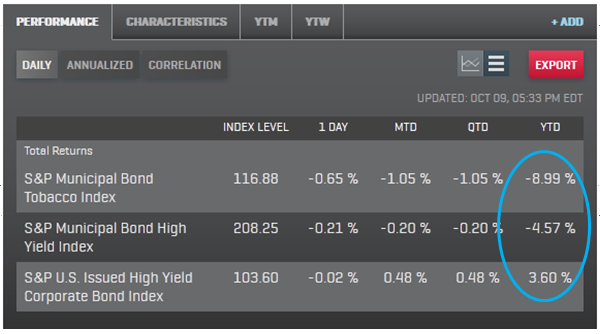

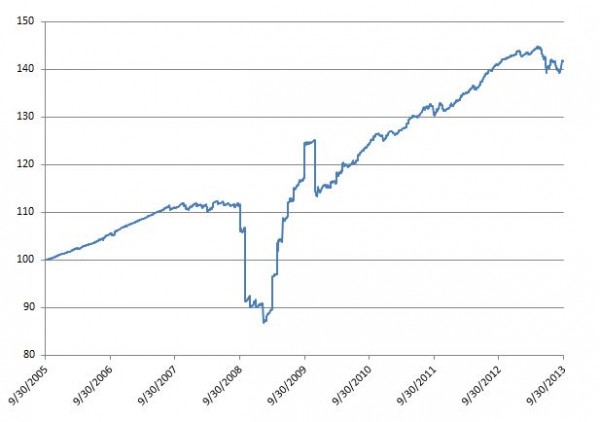

The Dow Jones Sukuk Total Return Index was created as an independent benchmark for investors seeking to track the performance and characteristics of U.S. dollar denominated and investment grade Sukuk issued in the global markets. The index rose 42% since it was first valued on September 30, 2005. On 10/14/2013, the yield to maturity was 3.10% with a duration of 4.35. The index is is currently tracking $33 billion of assets.

So how are the constituents of the Sukuk indices screened for Shariah compliance? First they must be certified as Sukuk by a globally recognized Shariah Supervisory Board. Second, they must comply with AAOIFI standards for tradable Sukuk. Lastly, the underlying assets must comply with Shariah principles, such the primary business are not engaged in any of the so-called prohibited industries.

As the Sukuk market evolves both in Asia and the Middle East, new Sukuk indices continue to be developed to meet growing investor demand for additional transparency into those markets. For example, the S&P MENA Sukuk Index was recently launched to specifically track the performance of Sukuk in the Middle East and North Africa (MENA) markets. These indices are designed to be broad benchmarks for both funds and ETFs.

The success of the continued Sukuk market expansion will rely on the depth of the secondary market. Global growth in the use of fixed income ETFs is an important trend and the introduction of ETFs in less liquid asset classes like Sukuk can definitely help drive liquidity.

The posts on this blog are opinions, not advice. Please read our Disclaimers.