One of the biggest things missing from the never ending healthcare debate is hard data. “Man-on-the-street” interviews reveal that some people don’t realize that Obamacare, the Patient Protection and Affordable Care Act and the ACA are all one and the same. The absence of factual data is most crucial when examining the cost of healthcare. One reason is that healthcare is a huge industry spread across the country and accounting for between a fifth and a sixth of GDP. A second issue is that detailed data dealing with individual is protected by law and unavailable.

The new S&P Healthcare Claims Indices launched today are a big step toward relieving the lack of data. These indices cover costs and utilization of inpatient and outpatient healthcare services and prescription drugs. They are based on actual health insurance claims with data provided by over 30 large national insurance plans. These indices will provide hard numbers to answer questions about how the cost of healthcare is rising or falling across the U.S. and for selected regions, states and cities. More information and the press release can be found here.

Branded prescription drugs are usually sold by only one company which developed the drug and owns a patent on the drug giving it a monopoly position in the market for that drug. Generic drugs are often sold by a number of companies, the patent may have expired and the market is more competitive. Since the S&P Healthcare Claims Indices collect data on both kinds of drugs separately, we can track the difference. The chart shows the unit costs for branded and generic. Generic unit costs vary widely, occasionally falling and never rising faster than 5% annually. Branded drug costs rise at 10% or more annual and appear to be accelerating.

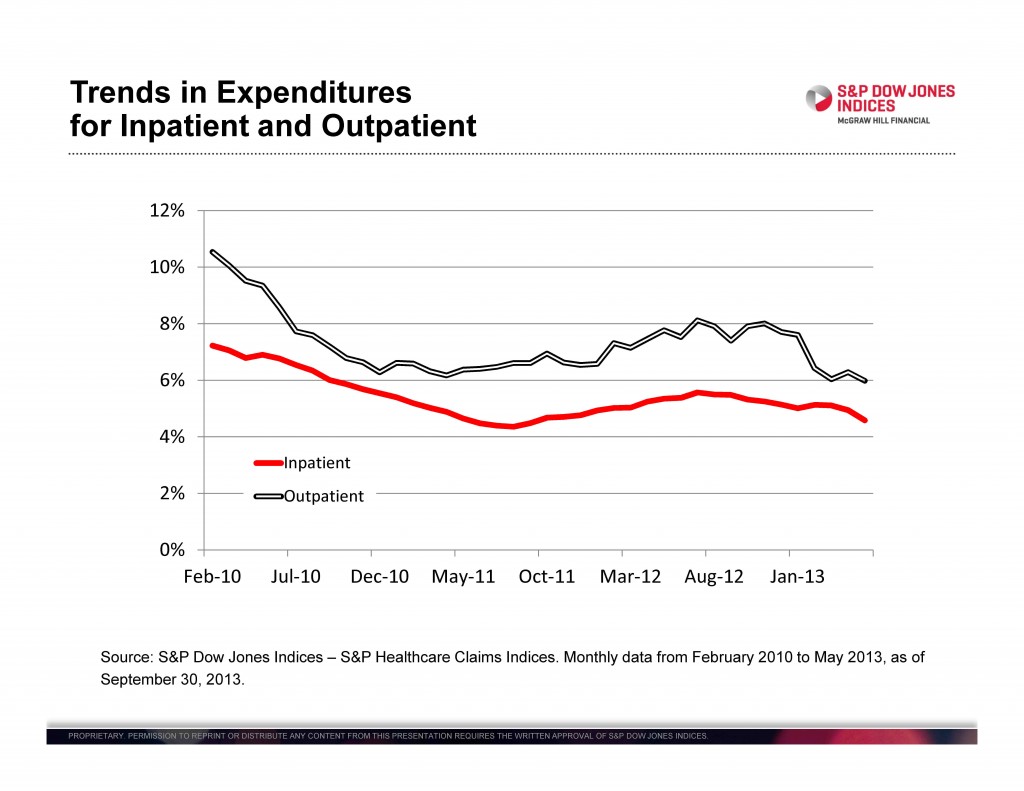

Many people see hospitals with their increasingly complex technology and large staffs as the big factor in rising healthcare expenditures. Inpatient hospitalization costs are rising, but costs for outpatient care are actually rising faster, as seen in the second chart. One cause may be efforts to move tests, examinations and routine surgery to outpatient centers from hospitals. Whatever the underlying cause is, concentrating only on hospitals won’t control some rapidly rising health care costs.

The posts on this blog are opinions, not advice. Please read our Disclaimers.