I am sure you have probably heard of, or even tried the Cantonese delicacies dim sum. While many people have a good knowledge of Barbecue Pork Bun or Siu Mai Dumplings, not many can tell exactly what is in the dim sum bond market.

Dim sum bonds are the debts that issued in the offshore renminbi (CNH) market. This market was initially developed in 2009 to meet the investment demand from the growing CNH deposits in Hong Kong. Supported by a healthy supply and demand dynamic, it recorded a significant expansion since then. The global investors continue to be attracted to this particular market due to the anticipation of currency appreciation and the exposure to Chinese credits.

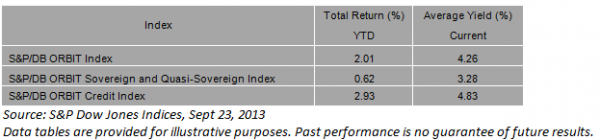

As tracked by the SP/DB Orbit Index, the total market value of the most liquid bonds and certificate of deposits (CD) with par amount above CNH 1 billion, is now over CNH 160 billion. The average yield of the index is 4.26% while the duration is 2.6. The index has delivered a total return of 5.28% since it incepted on Dec 31, 2010. If we take into the consideration of currency appreciation, the S&P/DB ORBIT (USD) Index rose 13.52%!

Similar to other markets, the offshore renminbi market is composed of sovereigns and quasi-sovereigns, as well as credits sectors. Under sovereigns and quasi-sovereigns, we have the bonds issued by Chinese government bonds, the four major policy banks in China, as well as the other global central bank, like Korean Development Bank. These bonds represented 39% weighting of the index.

There is also a very diversified issuers profile under the credits sector. For the Chinese properties, there are names like Yanlord and Gemdale. For Chinese corporates, we have some stated—owned corporates such as Shanghai Baosteel and Huaneng Power. There are also more foreign corporates, like Renault and Caterpillar entering into this market; in fact over 25% of the S&P/DB ORBIT index is composed of non-Hong Kong / China domiciled companies. Issuers continued to tap into the CNH market for a few reasons, firstly the offshore market offered a cost benefit compared with the onshore market, however it is no longer the case as the yields gradually converged, the offshore market is now trading around 50bp discount to onshore. Secondly, depending on the cross currency swap, some issuers may find it cheaper to issue in CNH than USD. Lastly, issuers may want to diversify its funding into CNH.

In terms of credit profile, 67% of the S&P/DB ORBIT Index is rated, and of which 55% of them are investment grade rated. While more issues are being rated nowadays, the overall creditworthiness of the market has also been enhanced.

On the other hand, liquidity has significantly improved as the regulatory continues its effort to internationalize the currency while the bond market matures. High yield names, particularly, have been very active this year, due to the high issuance and attractive yields. For example, a one-year paper of RENAULT, rated BB+, is trading about 4.30%. The average yield for high yield credits is around 7.75%, for duration of 2.3.

Perhaps one credit that got most attention recently is I.T. LTD, it is an apparel company found in Hong Kong and rapidly expanding its footprints in mainland China. Its major clienteles are the young Chinese generation with high purchasing power. It is not difficult to witness it when you walk into one of their shops in Shanghai, you can see one cardigan is easily priced in the range of USD 300-400 equivalents and it is bought without blinking an eye. Despite the strong consumer spending, the bond that the company issued at 6.25% in May plunged soon after it issued a profit warning, it is currently trading around 11%.

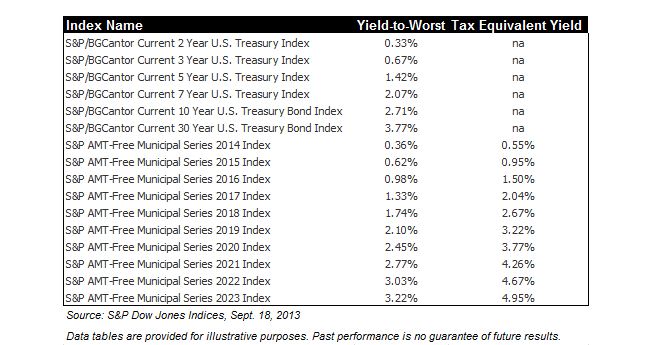

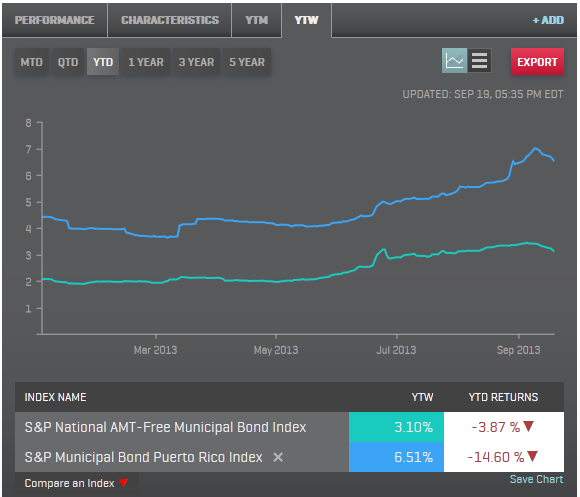

One thing to note, the S&P/DB ORBIT Index exhibited negative correlation to the U.S. treasury market while it also historically delivered a better risk-adjusted return, thus it provides investors an excellent way to diversify the fixed income portfolio, particularly in the current interest rate environment.