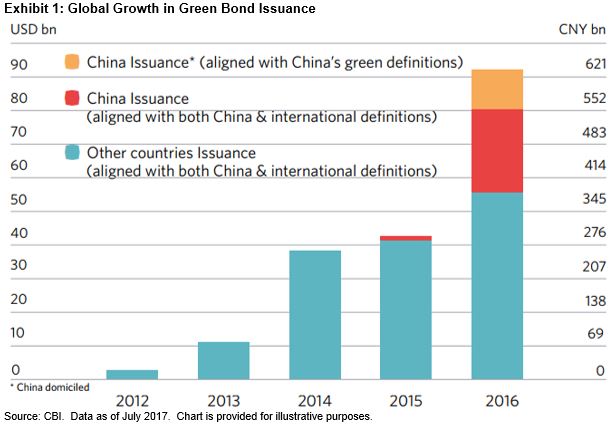

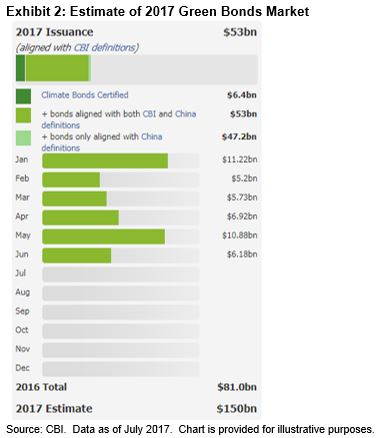

Green infrastructure, especially clean and renewable energy, is at the heart of Indian ESG efforts today. Despite the U.S.’s withdrawal from the Paris Agreement, India stands with its commitments made at Paris. The Indian government’s commitment—in context of the recent ratification of the Paris Agreement—is to reduce emissions by 33% to 35% by 2030 and increase the share of non-fossil-fuel-based power generation capacity to 40% of installed electric power capacity, creating new business and investment opportunities. Achieving India’s target of adding 175 gigawatts of renewable energy capacity by 2022 will require an investment of USD 200 billion. Assuming a debt-to-equity ratio of 3:1, the sector will require close to USD 150 billion in debt. Green bonds have started playing a role in financing this capacity and are expected to play a significant role in funding future expansions in renewable energy capacity. The development of green bonds in India is in its beginning stages and, according to the previous reports, four banks have started implementing green bonds: Yes bank, EXIM bank, IDBI bank, and Axis bank. Despite this, India has become the seventh largest market for green bonds worldwide, with around USD 3 billion of issuance as of April 2017.

The environment for enabling sustainable investment in Indian-listed equities is currently weak. Despite some notable exceptions from companies such as Trucost, ESG research coverage is still relatively limited. Numerous organizations such as The Energy and Resources Institute, the Confederation of Indian Industry, the UN Global Compact, and the International Finance Corporation are active in promoting corporate responsibility and sustainability reporting. ESG transparency and disclosure by Indian companies in the form of corporate sustainability reports and responses to the Carbon Disclosure Project are slowly improving, but from a low starting point.

However, there is relatively strong and growing interest in ESG risks and opportunities among India’s foreign institutional investors (FIIs), such as large pension funds and asset managers. Many of these stakeholders are signatories of the UN Principles for Responsible Investment, which has also shown interest in working in India. Additionally, the National Stock Exchange of India and Bombay Stock Exchange (BSE) have committed to take some leadership in raising ESG awareness among Indian companies and domestic market participants and to brokering a dialogue about these issues between the business community and FIIs.

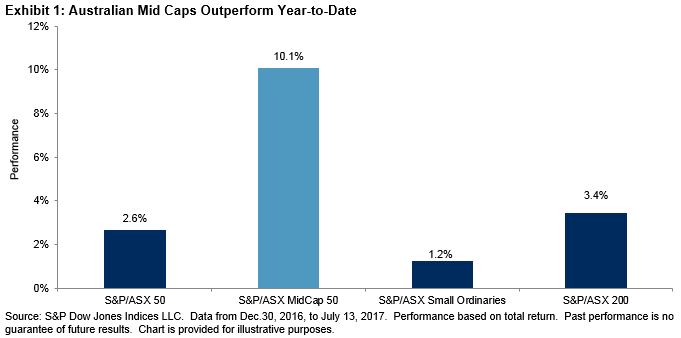

BSE, being a responsible stock exchange, is taking various initiatives in the domain of sustainability and corporate social responsibility. BSE has launched theme-based indices like the S&P BSE Carbonex and S&P BSE Greenex and is participating in the sustainable stock exchanges initiative. BSE has also signed a Memorandum of Understanding with the Ministry of Corporate Affairs to launch a corporate social responsibility index.

The posts on this blog are opinions, not advice. Please read our Disclaimers.