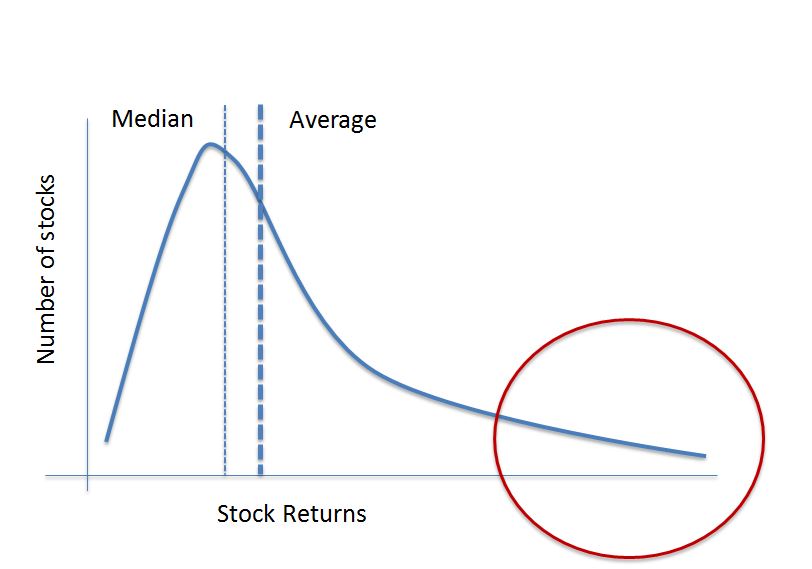

When an investor buys a stock her largest possible loss is the money invested while the gain is unlimited. Most investors avoid losing their entire investment, few investors make as much as they hoped. One result of this favorable bias is that the distribution of stock returns is usually skewed to the right. The sketch shows what the distribution would look like.

The skew explains why an equally weighted version of an index often outperforms the cap- or value-weighted version of the same index. It also provides a reason unrelated to fees for active managers’ difficulty in beating their index benchmarks. If the distribution of prices is skewed to the right with a long right hand tail, the average return across all the stocks will be greater than the median return. Why? Because a few very high return stocks at the extreme right pull up the average. An investor who owns the stocks in the right hand tail will do much better than either the median or the average. The equal weight S&P 500 returned 12.2% from Election Day to April 26th. The average return across all the stocks – because of the equal weighting – is close to the 12.2% return. However, in the right hand tail are six stocks that each returned more than 50%.

An active manager would probably hold far fewer than all 500 stocks in the S&P 500. With each stock he selects for his portfolio there is a 50/50 chance it is below the median and a less than 50/50 chance it is above the average. There is a much smaller chance he selects a stock in the right hand tail. The active manage must be very skilled, or very lucky, to find those in the tail. But without a few names at the extreme right end of the distribution, it will be difficult to beat the index. The longer the tail the more important it is to hold those stocks.

A manager who buys all the stocks in the index is assured of owning the right hand tail as well as the worst performing stocks on the left edge — he will be an index manager except for the way the stocks are weighted.

The skew explains one reason why an equal weighted index will typically out performs a cap-weighted index. In a cap weighted index, the larger the stock the larger its weight in the index and the larger the proportion of money invested in large stocks. In a portfolio tracking the cap-weighted S&P 500, more than half the money is in the 50 largest stocks. If all stocks have an equal chance being among the best performers but half the money is in only 10% of the stocks, a lot of the money is likely to be in the wrong place and miss the best performers. An equal weighted index is different – an equal amount of the funds track each stock so that gives each dollar has an equal chance of being the right place.

Portfolios tracking equal weighted indices also benefit from the small cap effect. Small cap stocks tend to outperform large cap stocks more often than not; and, small caps get more weight in equally weighted than cap-weight portfolios.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

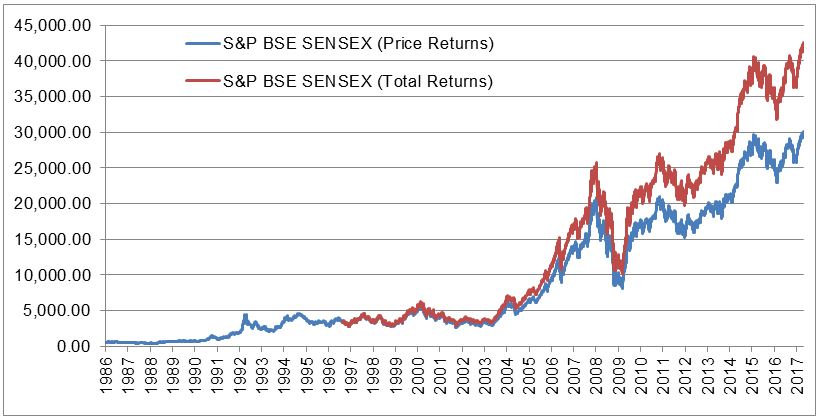

Source: S&P Dow Jones Indices LLC. Data from Jan. 2, 1986, to Apr. 26, 2017. Chart is provided for illustrative purposes. Past performance is no guarantee of future results.

Source: S&P Dow Jones Indices LLC. Data from Jan. 2, 1986, to Apr. 26, 2017. Chart is provided for illustrative purposes. Past performance is no guarantee of future results.