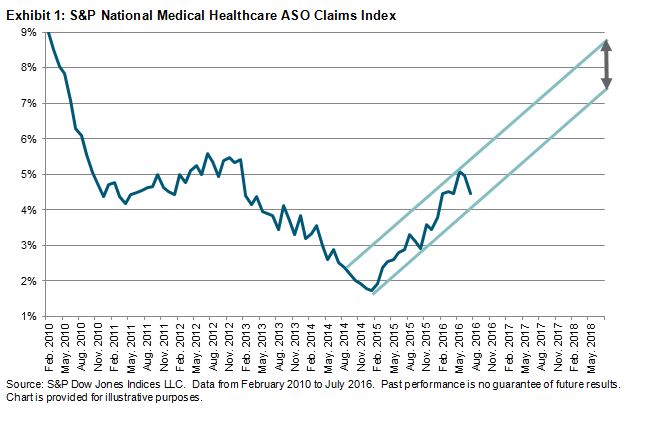

According to the S&P Healthcare Claims Indices, employers should be cautious about getting comfortable with trends in the 4.5%-5% range. While the most recent data indicates that trends dropped from almost 5% in June 2016 to around 4.5% in July 2016, the overall movement of the trend is still upward. The S&P National Medical Healthcare ASO Claims Index has been steadily gaining since January 2015, when it reached a low of 1.73% on a national basis (see Exhibit 1). Over this period of time, the trend has moved in a narrow corridor, approximately 100 bps wide. Other than three individual months where the trend moved 0.63% (May 2016) and 0.68% (February and November 2015), it has not deviated more than 0.50% in any given month. In fact, the average trend change over that period has been an increase of 0.19%. What happens if it continues to move in this corridor over the next 12 to 24 months? If this were to happen, then in 12 months’ time, the trend could be between 5.76% and 6.76%, and by July 2018, it could be between 7.56% and 8.56%. This represents a significant change from where the trend is today. Of course, many market factors could play a role to change the current pattern. In the next post, we will look at some select geographies across the U.S. to study their change in trends over the past several years.