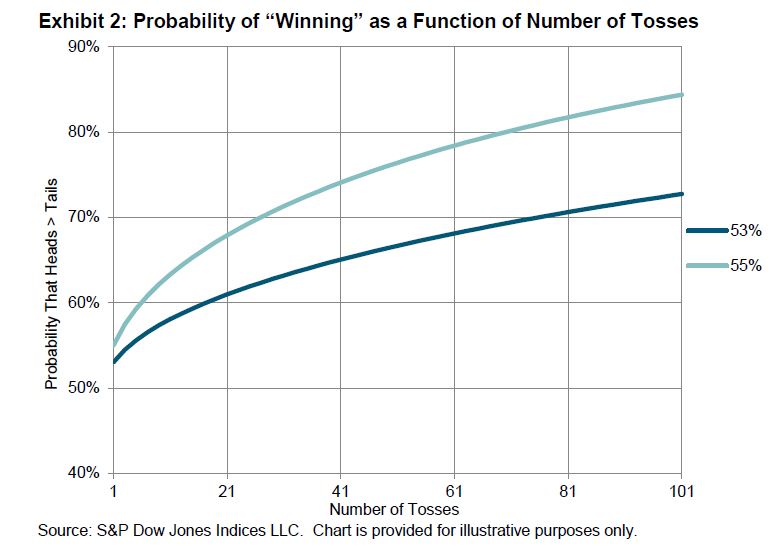

Some active managers argue that the remedy for widespread active underperformance is more aggressive, more concentrated portfolios. If this is the correct prescription, it has a number of adverse side effects — for example, risk is likely to increase, and the relative importance of skill and luck in decision making is likely to shift in luck’s favor.

A third consequence is that trading costs are likely to increase significantly. This is because — with more concentrated portfolios — both fund turnover and cost-per-trade should rise. Here’s a simplified example: Two managers share the same security rankings but construct their portfolios differently. The first manager selects the top-ranked 10% of the universe, and operates the more concentrated fund. The second manager excludes the bottom-ranked 10% of the universe (and therefore holds the top-ranked 90%). Suppose that in each quarter there is X% turnover in the securities ranked in the top 10% and the same X% turnover among the worst 10%.

Consider the turnover required for each manager, assuming that their portfolios are equally weighted and that they both rebalance once per quarter:

- The concentrated manager holds the top 10% of the universe. His turnover will therefore be X%.

- The diversified manager holds everything but the bottom 10%. There is X% turnover in the stocks he doesn’t own, which leads to a turnover of (X/9)% in those he does.

In this scenario, the concentrated manager’s turnover is nine times higher than the diversified manager’s turnover. Of course, the specifics depend on what fraction of the universe each manager chooses to hold. (With quintiles instead of deciles, the concentrated manager’s turnover would be “only” four times higher than the diversified manager’s.) But it’s difficult to escape the conclusion that turnover will rise as concentration rises.

Moreover, transaction costs per trade are also likely to rise. Transaction costs are not linear: it typically costs more to trade a higher percentage of the outstanding float in a security. Otherwise said, a manager is likely to be able to purchase 10,000 shares in each of 100 companies with less market impact than he could buy 1,000,000 shares of a single company.

Thus, higher concentration can deliver a double blow to returns: higher turnover and a higher unit cost of execution.

The posts on this blog are opinions, not advice. Please read our Disclaimers.