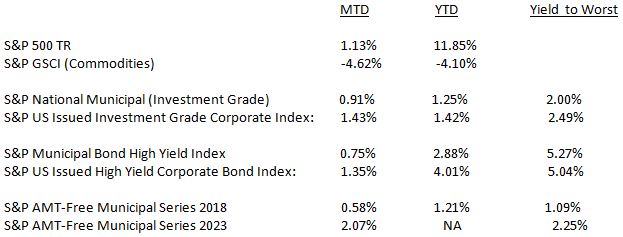

The S&P National AMT-Free Municipal Bond Index is up 1.25% year to date improving by 0.91% so far in April. Exactly where we were at the end of last week.

The ‘belly’ of the curve, or the 5 to 10 year maturity range, is performing as well as longer term bonds as the weighted average yield of bonds in the 5 year S&P AMT-Free Muni Series 2018 Index have come down by 11 bps in April, exactly where we were at the end of last week, to return 1.21% year to date. Ten year bonds in the 2023 Index have improved by 25bps to end at a weighted average yield of 2.25%.

Even with a slip of 3 bps to the cheaper since month end, the high yield municipal bond market tracked by the S&P Municipal Bond High Yield Index remains on track to making April the 17th consecutive month in a row where it has seen a positive monthly return. Year to date the high yield municipal bond market has returned 2.88% with April contributing 0.75% so far. The yield to worst of these bonds is a 5.27% (tax-free) while investment grade corporate bonds in the S&P U.S. Issued High Yield Corporate Bond Index have a weighted average yield to worst of 5.04% (taxable).

Comparing municipal bonds to other asset classes:

The posts on this blog are opinions, not advice. Please read our Disclaimers.