Many US financial advisors must feel like they are “under the gun” as the President and parts of his administration call for a stronger fiduciary standard. Simultaneously, I receive several emails per day on “robo-advisors” and how they spell doom for financial advice as we know it. I find the second challenge to financial advisors much more interesting. I’ll share my reasons for why I think that robo-advice may disrupt the business of some financial advisors.

Robo-advice is a form of financial advice that provides portfolio management online with no or minimal human intervention. Robo recommendations are generally index-based products in an all-asset and global portfolio which is selected by algorithms based on client input and risk tolerances. The consensus seems to be that robo-advisors aren’t serving high net worth clients. This is where many articles I have read end and suggest that after all, advisors need not worry since robos don’t compete for the same clients. So, no conflict, right? The mass affluent client or professional millennial who is emerging affluent that a robo-advisor recruits today is below a financial advisor’s investable asset minimum. But any wealth management firm with a strategic plan needs to realize that robo-advice is actively targeting its client of the future. And if robos provide useful and inexpensive financial advice to that client for any meaningful period of time, then what incentive will that client have to switch over to “full service” wealth management at some future date?

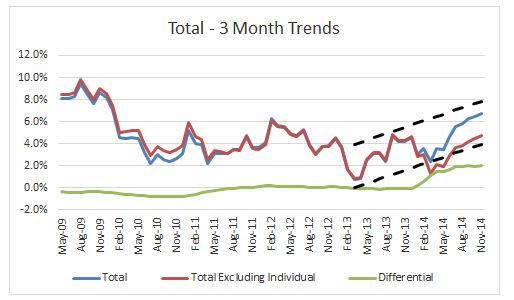

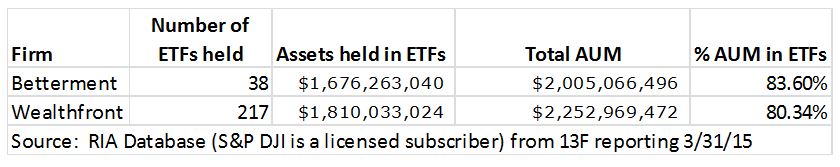

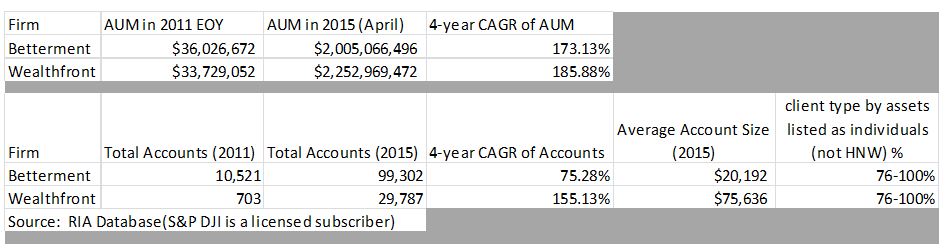

How disruptive might this be to financial advisors as a whole? That depends on how many of their future clients robos can pick off. We have some insight now on how well robos are doing in targeting these future clients, and let’s just say that some of them are gathering assets like…a machine. Two of the better-known robo-advisors are New York-based Betterment and California-based Wealthfront. Since both these firms are registered with the SEC as RIAs, we can see details about their compounded annual growth rates:

Seen from the perspective of an RIA, these two robo-advisors are large in AUM, growing extremely fast, and they have accumulated their growth by targeting relatively small account clients. Some articles make the point that these two robo-advisor firms are not yet profitable and sustain themselves on private equity money. With the CAGRs they have proven in AUM and client acquisition, how much longer will this lack of profitability be factual? And how disruptive will this be if in three years, if each of these firms is at $10 Billion dollars in AUM? Not possible? Vanguard Personal Advisor Services, which I consider to be a hybrid of robo and human advice is now at $17 Billion in AUM.

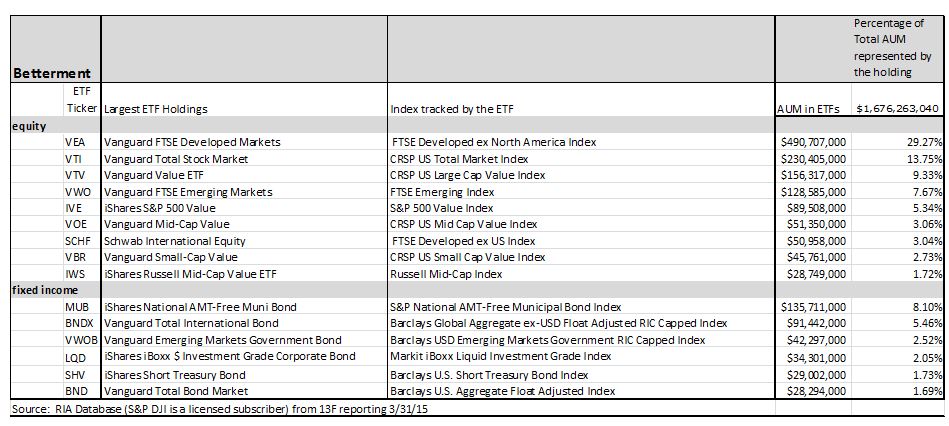

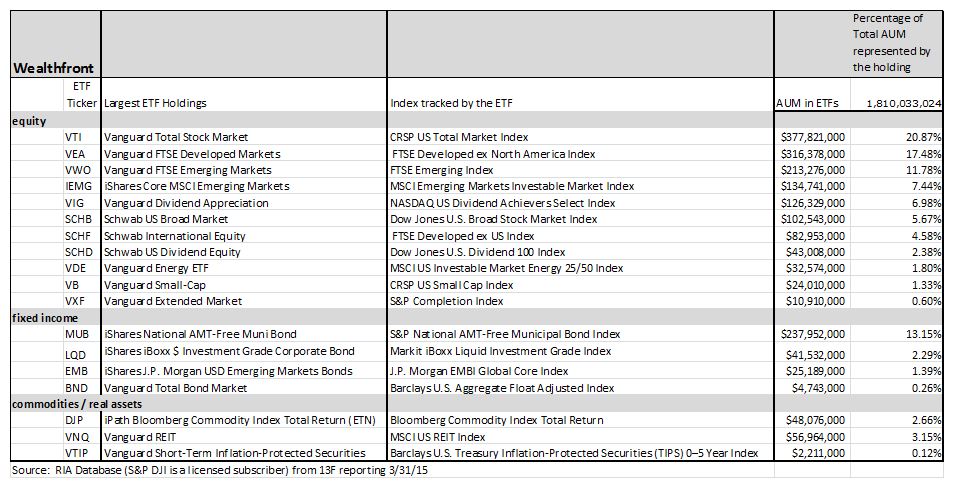

Another aspect of this disruption is that like RIA strategists, robo-advisors are power-users of indexing and ETFs. In my next post I will look at what Betterment and Wealthfront reportedly hold and how I think that what they hold may inform core investing and asset allocation.

In the end, I believe that some human financial advisors will mitigate this disruption risk by either adopting a robo-advice capability themselves or by sharpening and effectively communicating how their value and service differs from robo-advice. Those advisory firms which fail to adapt to what robo-advice means as a disruptor may find it much harder to compete or to be profitable in the years to come.

The posts on this blog are opinions, not advice. Please read our Disclaimers.