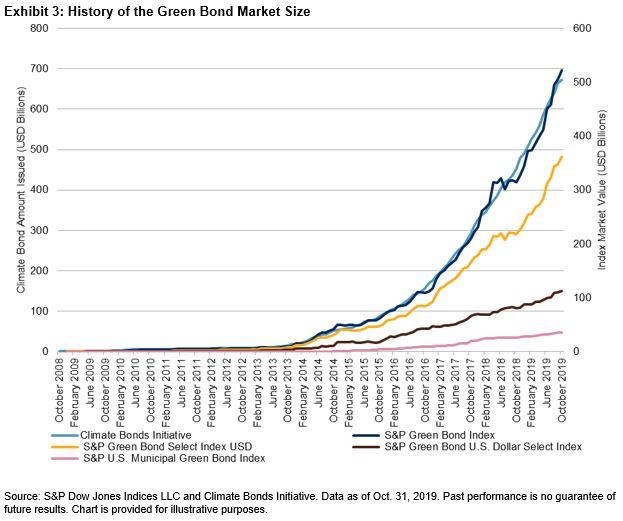

In June 2019, Reuters published that green bond issuance for the year had surpassed USD 100 billion,[1] which extolled a milestone of the first time the green bond issuance pace had reached the USD 100 billion mark by the first half of the year. Issuance could be on track to double by the end of the year. Since the end of June, USD 90 billion more has been issued, bringing the 2019 total to USD 212 billion in issuance as of October 2019.

When looking at country of issuance, the U.S. led national rankings, followed by France, China, Germany, and the Netherlands.

Derived from the same data, though organized for index use, the S&P Green Bond Index contains 5,774 bonds with a market value of USD 546 billion. Originally launched in 2014, the S&P Green Bond Index is a broad market index that is designed to measure the performance of green bonds regardless of size, coupon, or structure. The index and its subindices have grown in size as issuance has continued to increase for the green bond market.

Like the green bond market, the top countries in the S&P Green Bond Index are the U.S., France, and China, which make up 17%, 14%, and 9% of the index’s weight, respectively. The ratings within the index have transitioned from the historic AAA of supranational, which in the past consisted of heavy issuers of green bonds, to its current breakdown, seen in Exhibits 3 & 4.

The makeup of the issuers also shifted from supranational and short duration to longer-dated and larger sovereign and corporate bonds. The weighted average maturity of the S&P Green Bond Index went from 2.5 years in 2012 to 9.5 years in 2019, with a modified duration of 6.5 years.

Exhibit 6 compares the 1-, 3-, 5-, and 10-year returns of the S&P Green Bond Index, of which corporates was around 50% for the index and the market. Since the majority of credits for the index and the overall market were investment grade (80%), Exhibit 4 compares investment-grade corporates in USD terms.

Currently, the green bond market is small when compared to the overall fixed income market. Issuance continues to increase along with the diversity of issuers. The existence of the green bond market and the S&P Green Bond Index is a start, but if capital markets are to meet the needs of the environment and reversing the damages of climate change, the scale of investment capital would have to be exponentially larger in order to meet the challenge.

[1] Learn more at the following link: https://www.reuters.com/article/us-bonds-environment/green-bond-issuance-surpasses-100-billion-so-far-this-year-data-idUSKCN1TQ11V.

The posts on this blog are opinions, not advice. Please read our Disclaimers.