Although there seems to be more research on economic forecast and market analysis than manager selection, selecting investment managers is just as challenging as direct investing and requires considerable experience and expertise. In this blog, we investigate the return distribution of fixed income and equity funds to highlight the challenge of successfully selecting outperforming active managers. Specifically, we incorporate risk-reward analysis by calculating the ratio of the median of positive excess returns over the median of negative excess returns. This ratio provides an intuitive comparison between the magnitude of upside gains and downside losses from selecting outperforming versus underperforming active managers. All else equal, the common belief is that a ratio greater than or equal to two is desirable.

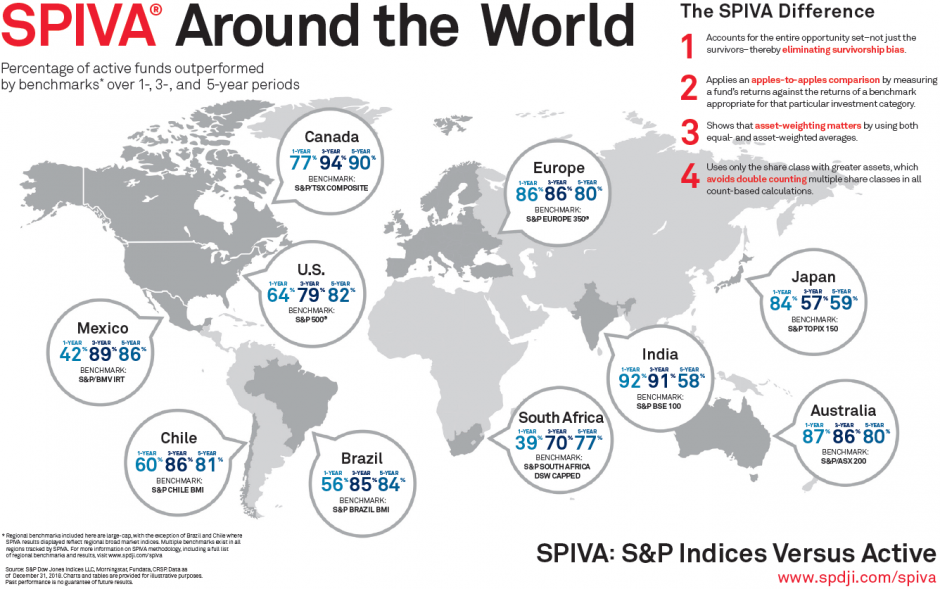

The underlying data for the analysis comes from our headline SPIVA® U.S. Scorecard, which uses the University of Chicago’s Center for Research and Security Prices (CRSP) Survivor-Bias-Free US Mutual Fund Database, the only complete database of both active and liquidated or merged mutual funds. The analysis focused on funds’ return distribution, and therefore eliminated funds that had missing returns for the entire reporting period.

Exhibits 1 and 2 show 5-year and 10-year net excess return distributions for equity and fixed income managers by category. We calculated excess return as the net-of-fees return of each fund subtracting its relevant benchmark index return.

The following are the key highlights from the exhibits.

- Equity managers had a harder time beating the benchmark than bond managers. The blue shade indicates the quartiles with positive net excess returns. For fixed income categories such as investment grade short and intermediate funds, global income funds, and municipal bond funds, more than half of the managers delivered positive excess returns. On the other hand, in most of the equity fund categories, except large-cap value funds, even top quartile managers were unable to outperform the benchmarks in both 5- and 10-year periods.

- No equity funds were able to demonstrate a risk-reward ratio greater than one. The yellow shade highlights risk-reward ratios greater than two. California municipal debt funds stood out as the only fund category for which the median upside of selecting outperforming managers doubled the median downside of selecting underperforming managers for both 5- and 10-year returns. In contrast, no equity manager had a ratio greater than one.

- Fixed income funds returns were more tightly clustered than equity funds. The interquartile range is a measure of statistical dispersion, calculated as the difference between the first and third quartile. In our case, it measures the range of alpha generated by the middle half of the managers within each fund category. The pink shades indicate that the interquartile range greater than 2% were more common for equity funds.

Consistent with prior research by S&P Dow Jones Indices,[1] we found that on a net-of-fees return basis, average managers did not outperform the benchmark over mid- to long-term horizons across all equity fund categories and many bond fund categories. Furthermore, the risk-reward analysis for picking outperforming managers versus underperforming ones demonstrated the challenge of manager selection and the expertise required to be successful in this field.

[1] https://spindices.com/documents/spiva/spiva-us-year-end-2018.pdf

The posts on this blog are opinions, not advice. Please read our Disclaimers.