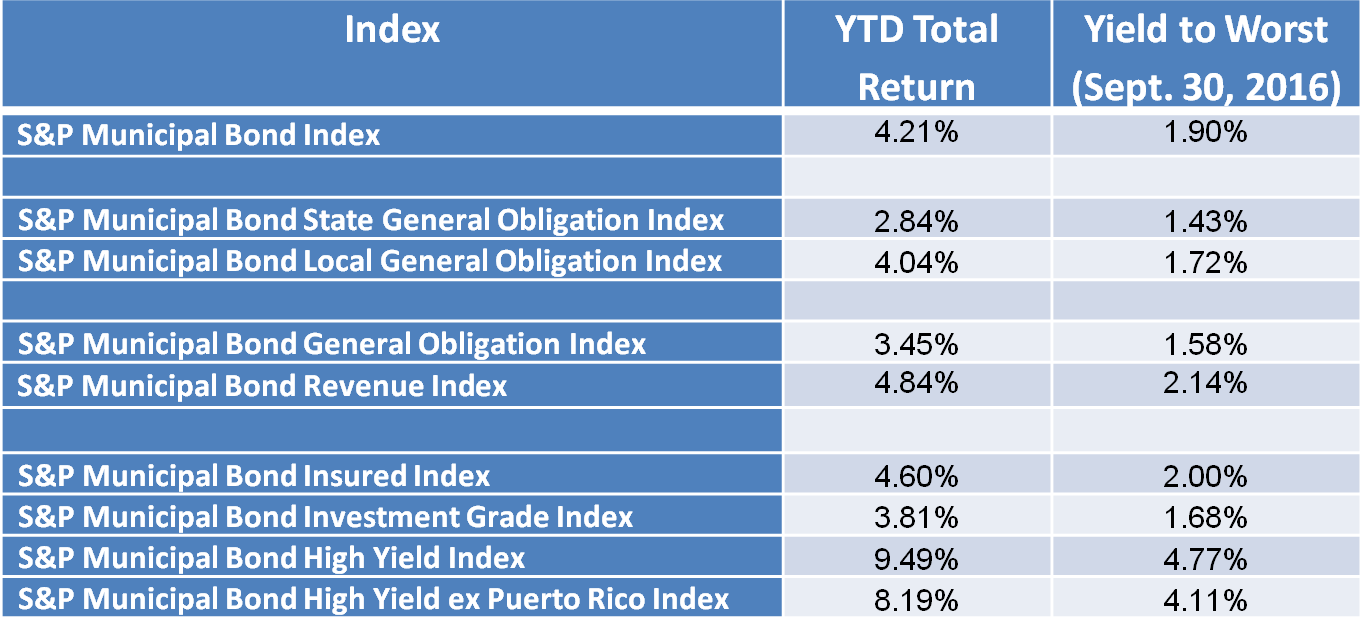

Through October 3rd, the S&P Municipal Bond Index has returned 4.23% year-to-date and the S&P 500 Bond Index has returned 8.97%. The 7 – 10 year maturity range has outpaced the overall benchmarks in both cases.

The average yield of bonds in the S&P 500 7-10 Year Investment Grade Corporate Bond Index has fallen by 94bps since year end as the yield thirsty market place has hunted yield oriented products. As a result, the index has seen a year-to-date total return of 9.15%.

The 7 – 10 year range of the municipal bond market has kept pace with U.S. Treasury bonds and nominal yields remain comparable to U.S. Treasury bonds. Meanwhile, taxable equivalent yields of the non-callable municipal bonds in that maturity range remain significantly higher and more in line with U.S. corporate bonds. Municipal bonds are sensitive to new issue supply and retail investor sentiment which can change the yield relationships between municipals and other asset classes.

Table 1) Select indices, their year-to-date returns and yields as of October 3rd, 2016: