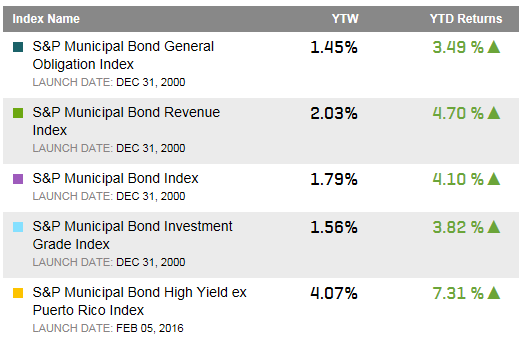

The debate over which sector of municipal bonds, general obligation bonds (G.O.’s) or revenue bonds can provide a better return is a constant one. So far in 2016, the S&P Municipal Bond Revenue Index has outperformed verses the S&P Municipal Bond General Obligation Index.

Peeling the onion back a bit may help provide more insights.

- In general, revenue bonds have a higher coupon and higher yield than general obligation bonds so that is a factor in return performance under normal market conditions. Year to date the G.O.’s have returned 3.49% while revenue bonds have returned 4.7%.

- While revenue bonds have indeed outperformed, the bond issues that are below investment grade revenue bonds are also a contributing factor. The S&P Municipal Bond High Yield Ex-Puerto Rico Index is up over 7.3% year-to-date and the majority of those bonds are revenue bonds and not general obligation bonds. In contrast, the S&P Municipal Bond Investment Grade Index which includes both G.O.’s and revenue bonds has returned over 3.8% year-to-date. (Note: Selected the S&P Municipal Bond High Yield Ex-Puerto Rico Index as Puerto Rico revenue bonds have seen a significant rebound in 2016 and would further skew the results).

Select municipal bond indices, their yields and total returns:

Please join me on Twitter @JRRieger and LinkedIn

The posts on this blog are opinions, not advice. Please read our Disclaimers.