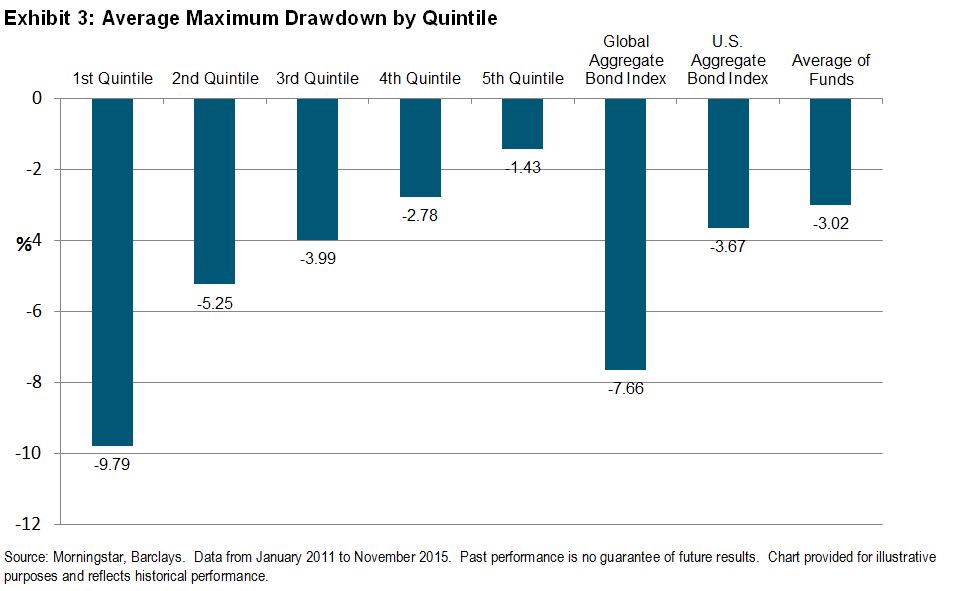

The question for the future of the private insurance system is this: are employers’ efforts to control healthcare costs futile? Recent data from the S&P Healthcare Claims Indices would suggest that this may actually be the case. According to the indices, costs for self-insured employers, known as Administrative Services Only (ASO) in the healthcare industry, are starting to increase again after showing declining cost trend levels from the 9% annual cost increases experienced in 2010. To illustrate this concern, when we peer deeper into the recent data and look at hospital inpatient charges, we see an alarming trend.

According to Exhibit 1, which looks at hospital inpatient costs, utilization, and average cost per day, employers have done remarkably well in controlling the utilization of services. This decline in utilization can be attributed to many things, including increasing participant costs for inpatient services, the ongoing substitution of outpatient facilities for services formerly done on an inpatient basis, as well as better education among the users of these services. However, what is evident is that even though utilization has declined since 2012, we have seen that average costs on the inpatient side have remained steady between USD 120 and USD 140 per member per month. How is it that utilization or use of healthcare services could be falling, while at the same time average costs are holding steady? The answer is evident in the average cost per inpatient per day index (unit cost) numbers. Unit costs have been mirroring in reverse the drop in utilization. This is a clear indication that as utilization drops, there is less revenue for service providers, and to compensate they have been increasing the fees charged for services to offset the revenue loss. If this is the case, employers must ask themselves if future efforts to instill cost control are going to be met with the same results.

The posts on this blog are opinions, not advice. Please read our Disclaimers.