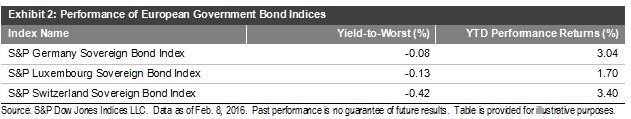

In honor of President’s Day, Election Year 2016 will be a new series of posts about how U.S. presidents and parties have impacted commodities through history. The index history goes back to Jan 2. 1970 when President Richard Nixon was in office. During the time period, there have been eight presidents, including three Democrats and five Republicans.

On average, the annualized returns of commodities during Democratic presidencies was 5.4%, almost 6 times better than under Republican presidencies that added just 0.9%. The S&P GSCI performed best under Republican President Nixon, gaining 21.9% annualized, but it also performed the worst under a Republican President, losing 16.6% annualized under President Ford.

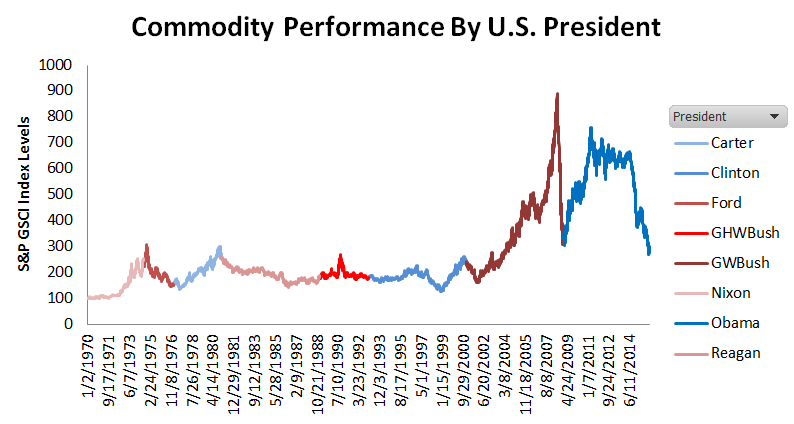

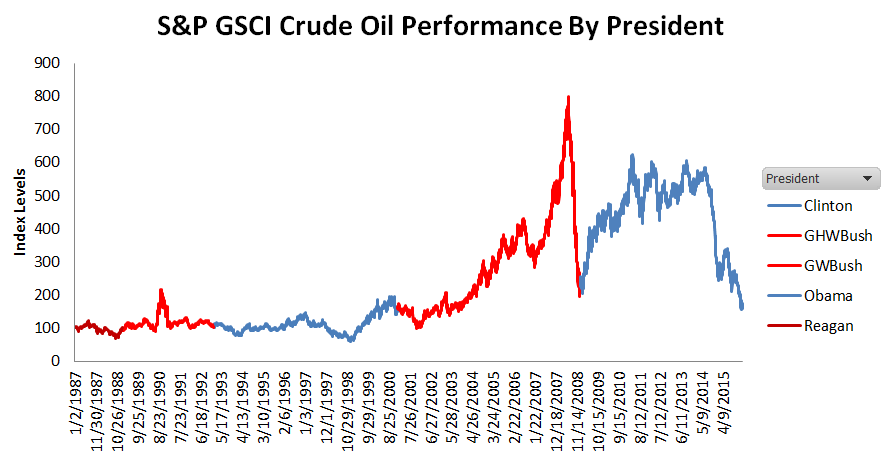

Many have a perception that U.S. Republican Presidents are good for oil given President George W. Bush’s oil business success. Overall, oil performed well during President George W. Bush’s time in office with an annualized return of 4.5%. From his start in 2001 until oil’s peak in July 2008, the commodity returned 388% or 23% annualized. However, he couldn’t stop the 71% drop that plagued his last six months of office.

It seemed hopeful with a party switch that the next president might help oil recover. Shortly after the inauguration, on Jan. 20, 2009, of the U.S. Democratic President Obama, oil bottomed then gained 179%, that is 56.3% annualized through April 2011. Unfortunately, he wasn’t able to stop an oil drop either, as it has fallen 72%, slightly more than it did in its drawdown under the prior president.

As it turns out, (WTI) crude oil was only added into the index in 1987, so there have been just five presidents to examine, but oil has only been negative under President Obama. Oil performed best under President Clinton with an annualized return of 6.2%, followed by Presidents George W. Bush (4.5%,) Reagan (1.2%,) George H.W. Bush (0.4%) and Obama (-3.4.)

On average, oil under the Republican Presidents returned 2.1% versus 1.4% under the Democratic Presidents. The Democratic Presidents represented both the best and the worst oil performance with oil performance during Republican Presidencies falling in the middle.

More important than the next elected party, the U.S. government may only have a meaningful impact for oil based on how (if) it regulates oil supply. Beyond the supply, the strength of the U.S. dollar may be the strongest domestic force on oil prices. There may need to be global coordination between OPEC and non-OPEC suppliers to cut production, and some demand strength from emerging markets, including China, in order for oil to turn around.

The posts on this blog are opinions, not advice. Please read our Disclaimers.