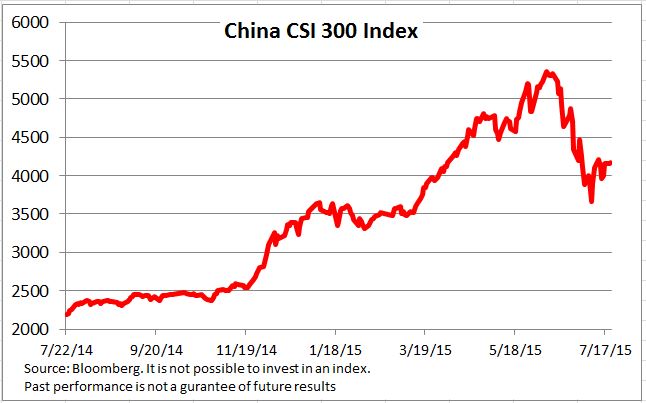

The Chinese Ministry of Finance (MoF) recently rolled out another muni replacement program of legacy local government debt, as the previous muni replacement quota of RMB 1 trillion only addresses about half of the local government debt that is due to expire in 2015. With the robust expansion plan, it is expected that the total supply of muni bonds will reach over RMB 2.77 trillion this year1.

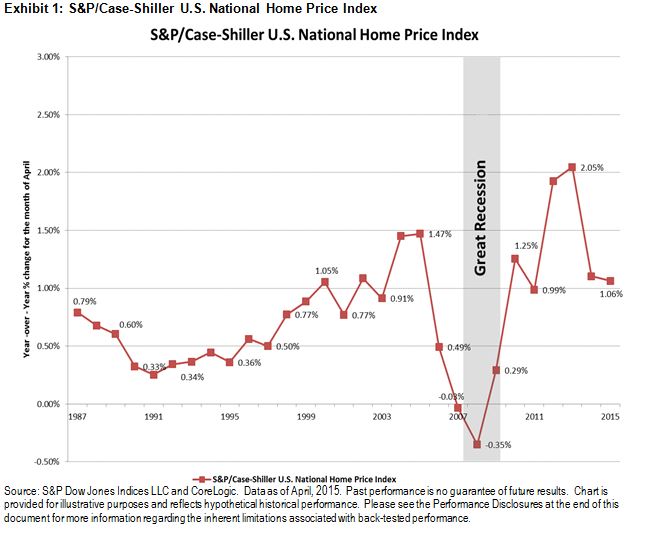

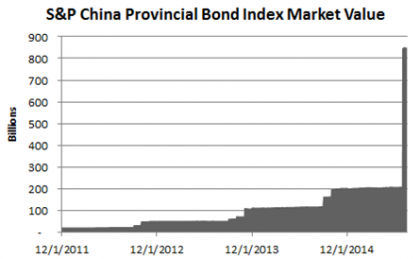

In fact, since Jiangsu’s debut issuance on May 18, 2015, the municipal bond market that is tracked by the S&P China Provincial Bond Index has expanded rapidly. In the June 2015 index rebalancing, the total number of muni bonds surged from 47 to 138, while the total par amount increased four times to CNY 847 billion (see Exhibit 1).

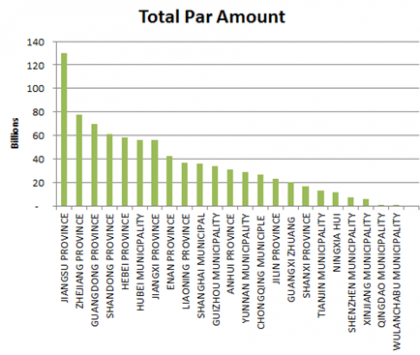

According to the S&P China Provincial Bond Index, the Jiangsu Province has the highest outstanding debt, at CNY 129 trillion, and it represents 15% of the index exposure, followed by the Zhejiang and Guangdong provinces (see Exhibit 2 for the provincial breakdown).

Of note, the new Chinese muni bonds were priced tight at issuance and they continue to trade at tight credit spreads above the sovereign bond yields. As of July 21, 2015, the yield-to-worst of the S&P China Provincial Bond Index was 3.49% (with a modified duration of 5.19), whereas the yield-to-worst of the S&P China Sovereign Bond Index was 3.15% (with a modified duration of 5.60).

Exhibit 1: Market Value tracked by the S&P China Provincial Bond Index

Exhibit 2: Total Par Amount by Provincial Breakdown

1 Source: HBSC Global Research

The posts on this blog are opinions, not advice. Please read our Disclaimers.