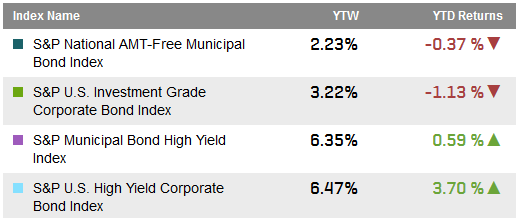

Data as of June 26, 2015:

The investment grade municipal bond market has managed to hold steady with a modest negative return of -0.37% through June 26th 2015. Investment grade corporate bonds have returned -1.13% during the same period.

High yield municipal bonds have been pulled downward by Puerto Rico but have still managed to eek out a positive return of 0.59%. Meanwhile, junk corporate bonds have returned 3.7% year-to-date.

Select Fixed Income Index Yields and returns:

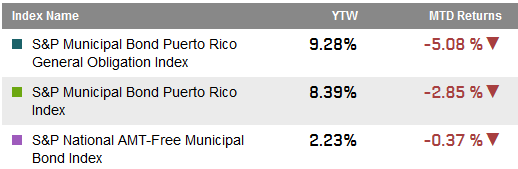

This past weekend Puerto Rico’s governor has stated the public debt is un-payable. Last week, the G.O. debt had plumbed new depths helping to record a negative 5% month-to-date return for the S&P Municipal Bond Puerto Rico General Obligation Index. The facts are the situation isn’t looking good: the pending PREPA July 1st default looms on the market, the possible restructuring of the Government Development Bank debt and the possible postponement of G.O. set – asides have sent alarms to G.O. bond holders.

Select Municipal Bond Indices: (Month-to-Date)

After years of turmoil, the events in Puerto Rico are beginning to come to a boil. The impact of defaults on the rest of the bond market, if any, remains to be seen.

The posts on this blog are opinions, not advice. Please read our Disclaimers.