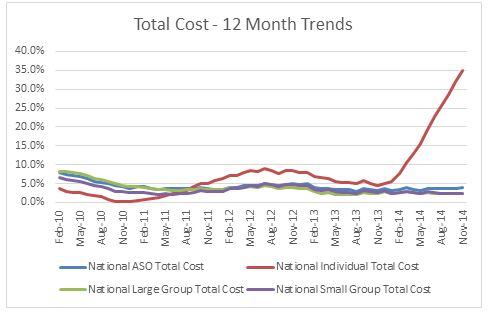

When we initiated our forecast on the S&P Claims Based Indices late in 2014 we wanted to avoid the effects of the ACA on individual and small group claim costs so we focused our models on the LG/ASO lines of business. Clearly, the 2014 experience on individual shows a sharp divergence in trends from the group business. Although the delay in the latest release caused some historic revisions in the data, the concept we outlined with our most recent forecast report seems to still be operative, although maybe somewhat muted.

We continue to expect there could be a trend bump in 2015 small group (SG) as electronic enrollment and exchanges for enrollment have become available. While enrollment is increasing, the capacity of hospitals, as measured by employment per capita, has declined below long term average levels and may be negative when compared to potential demand—when considering the impact of the increased number of newly insured. Medicare initiatives to cut readmissions and to increase longer emergency room treatment holds to avoid unnecessary admissions have been affecting both Medicare and non-Medicare hospital patients by reducing admissions.[1]

Our operative theory is that healthcare is primarily a supply driven system, due to consumers being immunized from significant cost due to the effect of insurance. This increases the demand above what it might otherwise have been in the absence of insurance. Although ongoing market increases in deductibles and co-pays have a downward effect on demand, this would only have a marginal impact relative to the effect of having no coverage at all. This was demonstrated in the Rand Health Insurance Experiment conducted from 1971 to 1986.