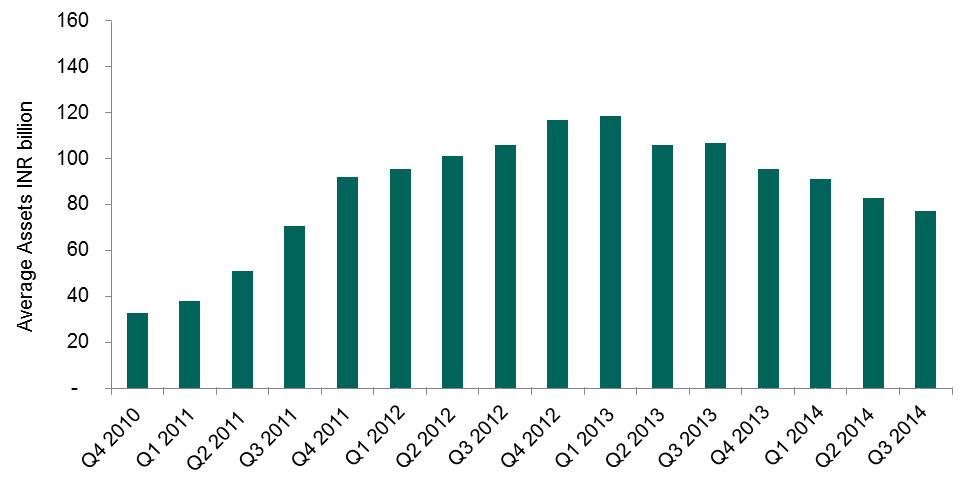

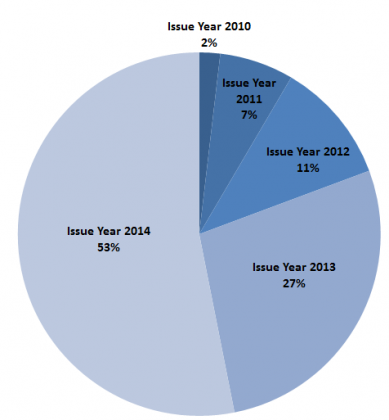

As tracked by the S&P/DB ORBIT Index, the size of the offshore renminbi bond market rose 66% year-to-date (YTD) and reached CNY 280 billion*, which reflected the robust supply in 2014. And if we look at the index exposure by issue year, the new issues in 2014 represent 53% of the index.

Exhibit 1: Index Exposure by Issue Year: The S&P/DB ORBIT Index

While it is not surprising to see the index is dominated by Chinese issuers at 89%, there is a continuous trend of country diversification within the index. For example, some of the new index inclusions this year are Fonterra, a multinational dairy company from New Zealand and Cagamas, the national mortgage corporation from Malaysia.

There are also signs that the offshore renminbi bond market is developing into a more matured market. Bonds with longer tenors tapped into the market, i.e. the Beijing Enterprise, the Export and Import Bank of China and the Chinese government all issued with 10-year. In terms of the rating profile, 46% of index exposure is rated by at least one of international rating agencies, whereas the investment grade rated bonds account for 41% of the index.

Looking at the index performance, the S&P/DB ORBIT Index delivered a total return of 2.32% YTD, or 1.23% in USD. On the sector level, the S&P/DB Orbit Credit Index rose 2.40% YTD, which outperformed the S&P/DB ORBIT Sovereign and Quasi-Sovereign Index that gained 2.19% in the same period.

*Data are as of Oct 22, 2014.

The posts on this blog are opinions, not advice. Please read our Disclaimers.