Over the recent years, the traditional divide between passive and active management has become increasingly blurred. In particular, institutional investors have shown growing interests in so call “alternative beta” or “smart beta” strategies that aim to deliver better risk adjusted performance than the market by taking active bets on systematic risk factors, while retaining the core benefits of passive investing such as low cost and transparency.

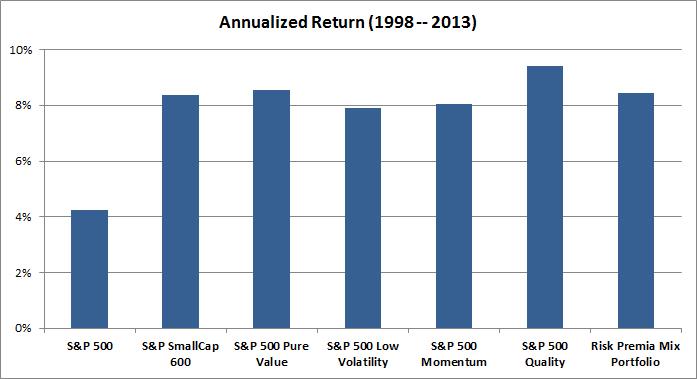

This trend is partly driven by the recognition that systematic risk premia explain the majority of long-term portfolio returns, and that a significant portion of the alpha delivered by active managers can be attributed to these systematic factors. The below Exhibit shows that, over the last 15 years, alternative beta strategies that capture exposures to factors such as value, low volatility, momentum and quality have significantly outperformed the S&P 500 by about 4% per annum.

Source: S&P Dow Jones Indices. Data from June 30, 1998 to June 30, 2013. Charts are provided for illustrative purposes. Past performance is not a guarantee of future results. Some data reflected in this chart may reflect hypothetical historical performance.

However, there are many challenges for institutional investors to evaluate and potentially implement alternative beta strategies. For instance, investing in alternative beta strategies involves active decisions and passive implementation, thus may require significantly different investment processes and governance than traditional passive or active mandates. In addition, the recent proliferation of these strategies makes the strategy selection and due diligence process a complex and time-consuming exercise. Last but not least, as risk premia factors are cyclical, these strategies may experience sustained periods of underperformance relative to the market.

Join us for a live 60-minute webinar on December 5, 2013 to hear our panel of industry thinkers from BlackRock, Mercer and S&P Dow Jones Indices discuss the trends, opportunities and challenges in alternative beta investing. Register here.

The posts on this blog are opinions, not advice. Please read our Disclaimers.