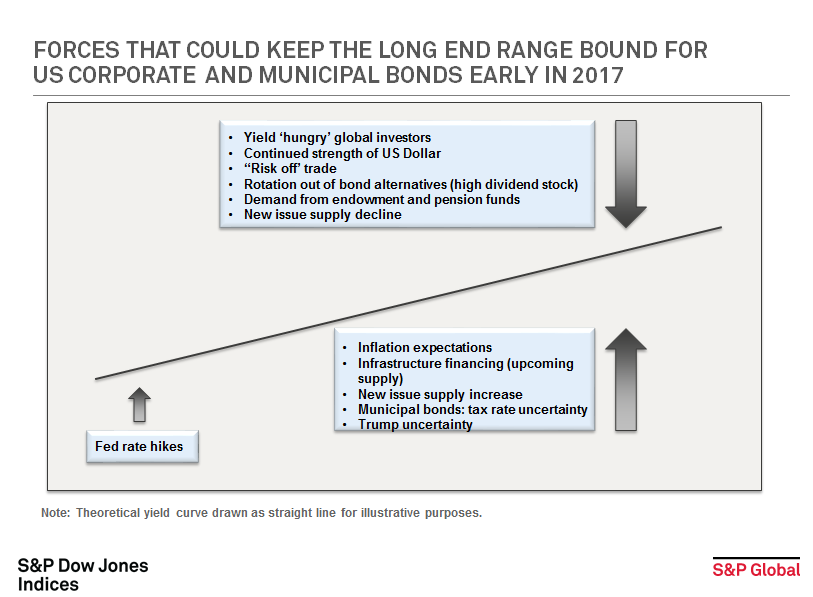

The long end of the yield curve for U.S. corporate and municipal bonds could be held range bound over the next several months as there are various forces at play.

Drivers for yields to rise:

- Inflation expectations: actual and anticipated inflation can impact bond holders and hits the yields of long term bonds the hardest.

- Infrastructure programs: uncertainty over how infrastructure improvements will be funded and the potential future new issue supply from such programs could also push yields up.

- New issue supply could continue to rise. CUSIP Global Services announced in November that requests for CUSIPs on new corporate and municipal debt continues to grow and municipal bond requests hit a new four month high.

- Specifically impacting municipal bonds is the uncertainty of future tax rates can hold bond prices down and keep yields up.

- ‘Trump uncertainty’, while not necessarily a defined term, the uncertainty a new president brings is probably the hardest for the market to determine.

Counterbalancing all of this is:

- The continued search for yield. Negative and zero yield bonds persist in the global markets and U.S. corporate and municipal bonds have become ‘go to’ asset classes for incremental yield as a result.

- The strength of the U.S. dollar is a positive for U.S. dollar denominated securities.

- U.S. corporate and municipal bonds have become part of the “risk off” trade. Recent dynamics that could disrupt investor behavior include the unknown future risks involving Russia, Syria, and China among others.

- As yields rise on the long end, U.S. pension and endowment funds may seek out long term bonds to replace the more volatile high dividend stock and other investment alternatives used to generate yield.

- Supply of new issues could stall for many reasons. For example, companies repatriating cash or which have already borrowed in the low rate environment may no longer need to borrow further.

Yields for investment grade U.S. Corporate and municipal bonds represented by Yield to Worst as we end 2016: (Data as of December 29, 2016)

S&P 500 Investment Grade Corporate Bond Index: 3.21%

S&P National AMT-Free Municipal Bond index (investment grade): 2.44% (The Taxable Equivalent Yield using a 39.6% tax rate would be 4.04%)

I am sure there are many other drivers and welcome other perspectives and view points.

The posts on this blog are opinions, not advice. Please read our Disclaimers.