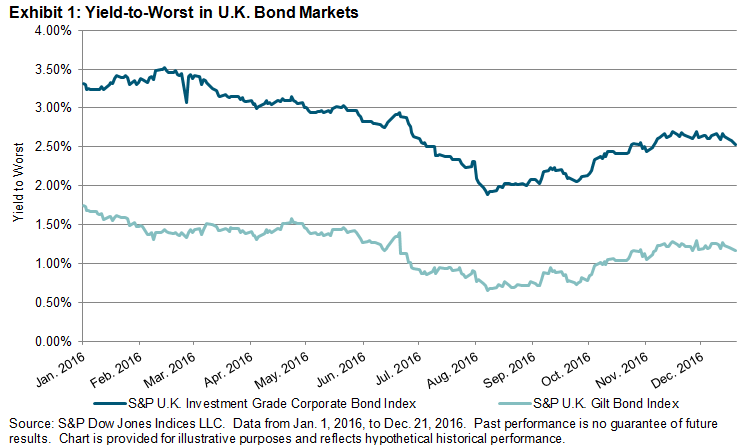

UK bond markets managed to perform well, with significant YTD returns during a year filled with public vote surprises, as well as both rate decreases and hikes globally. The S&P U.K. Investment Grade Corporate Bond Index had a YTD return of 10.75% as of Dec. 21, 2016, while the S&P U.K. Gilt Bond Index gained 8.72%. During the same period, corporate bond yields tightened 76 bps and U.K. gilts have tightened 57 bps, but not without some swings in between.

In June 2016, UK bond markets responded to the unexpected Brexit vote by tightening, which equates to bond prices going up and yields going down. The S&P U.K. Gilt Bond Index tightened 28 bps, as uncertainty over the Brexit’s effect on the UK economy prompted market participants to buy bonds with the highest quality—UK gilts—a phenomenon known as the “flight to quality” effect. Despite the uncertainty of Brexit’s effect on UK corporations, the S&P U.K. Investment Grade Corporate Bond Index also tightened by a more modest 5 bps.

August saw yields sink to their lowest point of the year (and highest prices) after the Bank of England (BoE) cut rates for the first time in seven years. Rates were cut to a record low of 0.25% from 0.5%, and the BoE also expanded its quantitative easing program. Bond markets generally react to the lowering of rates by rallying, causing yields to go down. The S&P U.K. Gilt Bond Index saw yields as low as 0.65%, while the S&P U.K. Investment Grade Corporate Bond Index was as low as 1.89%.

Moving to November 2016, the surprise win by Trump in the U.S. presidential election saw UK bonds responding mutely, with prices selling off. UK investment-grade corporate bond yields widened 5 bps and UK Gilts widened 1 bp immediately after the results. This was attributed largely to comments made by Trump about spending. A Trump spending spree in U.S. infrastructure would cause an increase in prices, and inflation fears are generally a negative for bond prices.

Rounding out the year, on Dec. 14, 2016, the U.S. Fed increased rates to the range of 0.5%-0.75% in response to a stronger U.S. economy and an increase in U.S. prices. UK gilts and corporate bond markets widened 8 bps, again in fear that rising rates will put negative pressure on bond markets. Since this move, UK bond yields have tightened back to levels seen just before the rate increase, indicating that despite rising global rates and inflationary fears, UK bond markets may still have room to rise.

The posts on this blog are opinions, not advice. Please read our Disclaimers.