As they begin their journey in environmental, social, and governance (ESG) investing, many market participants are realizing that there are multiple ways in which an index methodology can incorporate ESG characteristics. Some strategies will look to screen out particular industry groups or companies participating in various business activities, while other strategies will make relative adjustments based on ESG scores. With the exception of a few eligibility criteria that are rather standard with ESG indices, the new S&P/NZX 50 Portfolio ESG Tilted Index takes the latter approach and tilts the weight of companies by their S&P DJI ESG Scores.

Using the S&P/NZX 50 Portfolio Index as the underlying benchmark, the ESG tilted index allows the same diversification across New Zealand sectors, while giving more weight to high ESG performing companies.

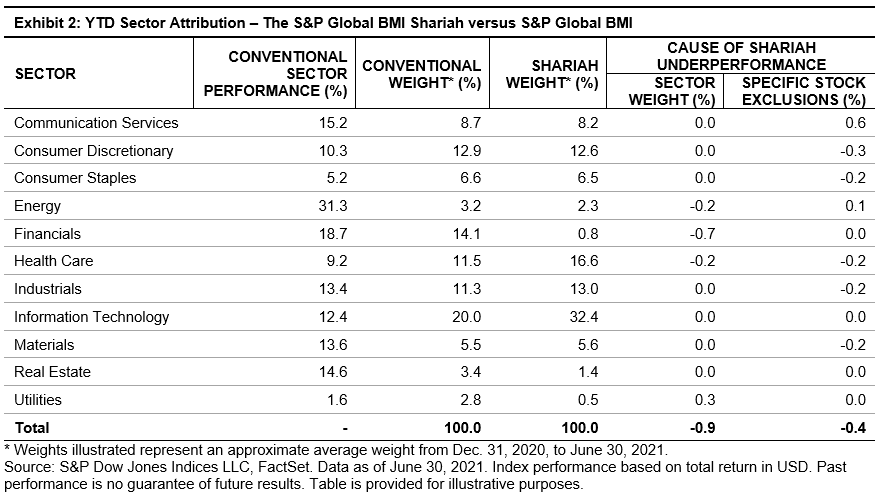

Though the history for the S&P/NZX 50 Portfolio ESG Tilted Index is limited due to availability of historical ESG data, since its inception date, the index’s performance has been stellar in comparison to its benchmark. The three- and five-year annualized returns outperformed the benchmark by 0.90% and 1.62%, respectively (see Exhibit 1).

S&P DJI ESG Scores are used as the primary dataset in evaluating the ESG performance of each constituent company. S&P DJI ESG Scores are the second set of ESG scores calculated by S&P Global ESG Research, in addition to the S&P Global ESG Scores that are used to define the Dow Jones Sustainability Indices constituents.

Each year, S&P Global conducts the Corporate Sustainability Assessment (CSA), in which analysts examine over 11,000 companies globally. The CSA has produced one of the world’s most comprehensive databases of financially material sustainability information.

Regarding index exclusions, there are several different business activities that deem a company ineligible for inclusion in the S&P/NZX 50 Portfolio ESG Tilted Index. These categories include controversial weapons, thermal coal, and tobacco. These are the same exclusions found in the S&P 500® ESG Tilted Index. In addition to the aforementioned business activities, in response to regulations and demand seen from the local New Zealand market, the methodology also excludes companies from the Energy sector as well as those that operate in the Casinos and Gaming sub-industry, as defined by GICS®.

Lastly, the index methodology also screens companies based on their accordance to the United Nations Global Compact (UNGC) Principles. This is done by utilizing Sustainalytics’ Global Standards Screening (GSS), which provides an assessment of a company’s impact on stakeholders and the extent to which a company causes, contributes, or is linked to violations of international norms and standards. Companies that are deemed “Non-Compliant” by Sustainalytics are ineligible for index inclusion.

As interest in and availability of ESG strategies are growing around the world, the same can be said for New Zealand. Market participants are making active decisions about the types of funds that they choose, and looking to ensure that those funds are aligned not only with their risk/return expectations, but that they also take material ESG matters into consideration.

There have been recent changes in New Zealand that have also been driving investor interest in ESG. For example, there has been increased attention to how responsible default providers for KiwiSaver (New Zealand pension funds) are with their investment portfolios. Another example is the Ministry of Business, Innovation & Employment applying rules around investments in companies with exposure to fossil fuel production and illegal weapons.

We are keeping an eye on these growing local and global trends to ensure that indexing strategies are in line with the expectations of not just investors, but also the policy makers that govern those respective markets.

The posts on this blog are opinions, not advice. Please read our Disclaimers.