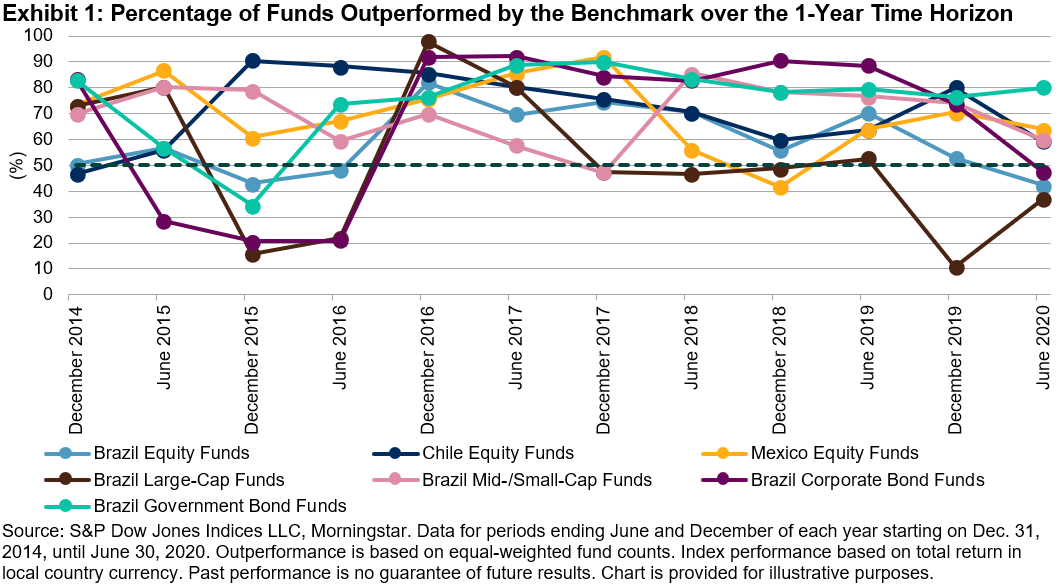

We recently published our industry-famous SPIVA report for the Latin America region. SPIVA, which stands for S&P Indices Versus Active, analyzes the performance of actively managed mutual funds against their respective category benchmark. In the case of Latin America, S&P Dow Jones Indices began publishing the scorecard in 2014, covering Brazil, Chile, and Mexico.

The SPIVA Latin America Mid-Year 2020 Scorecard shows that the majority of active equity managers in Chile and Mexico failed to outperform their benchmarks over 1-, 3-, 5-, and 10-year periods, even when the first half of 2020 offered abundant opportunities for active managers. The dispersion and volatility of the S&P Latin America BMI’s constituents remained above the historical median for four of the six months.1

However, Brazilian active managers in the Brazil Equity Funds, Brazil Large-Cap Funds, and Brazil Corporate Bond Funds categories managed to take advantage of the circumstances in the short term. We have seen this outperformance by active managers on a short-term basis in the past as well.

A compilation of the Latin America SPIVA scorecards from year-end 2014 to mid-year 2020 show that when observing one-year periods, Chilean active managers outperformed in December 2014; Brazilian active managers outperformed in one or more of their categories in June 2015, December 2015, and June 2016; and the majority of Mexican equity active managers were able to beat their benchmarks in December 2019 (see Exhibit 1).

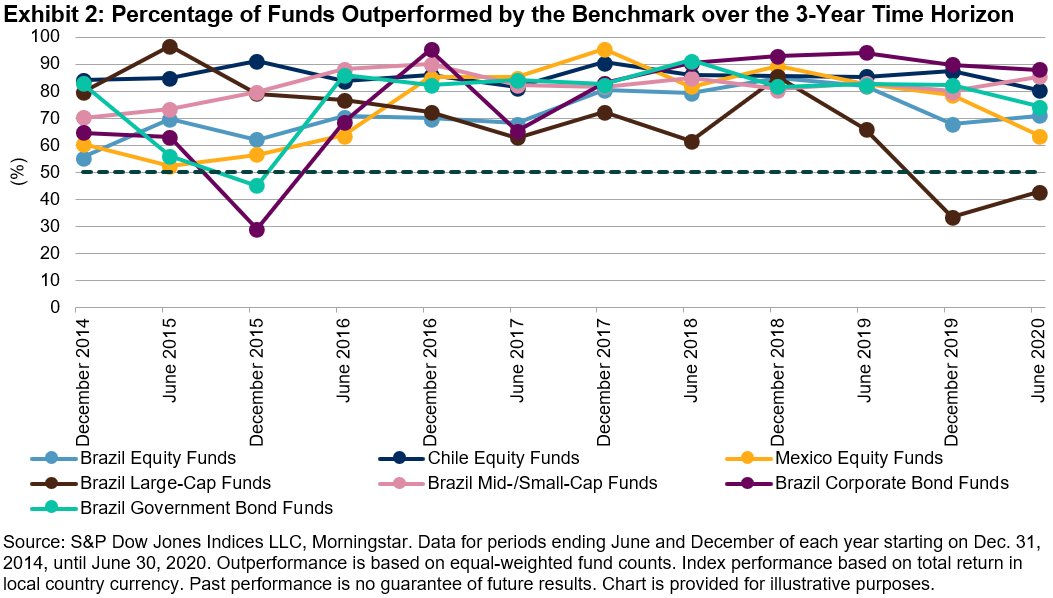

However, when compared with a longer time horizon, say a three-year period, we see that the percentage of active managers outperforming goes down.

However, when compared with a longer time horizon, say a three-year period, we see that the percentage of active managers outperforming goes down.

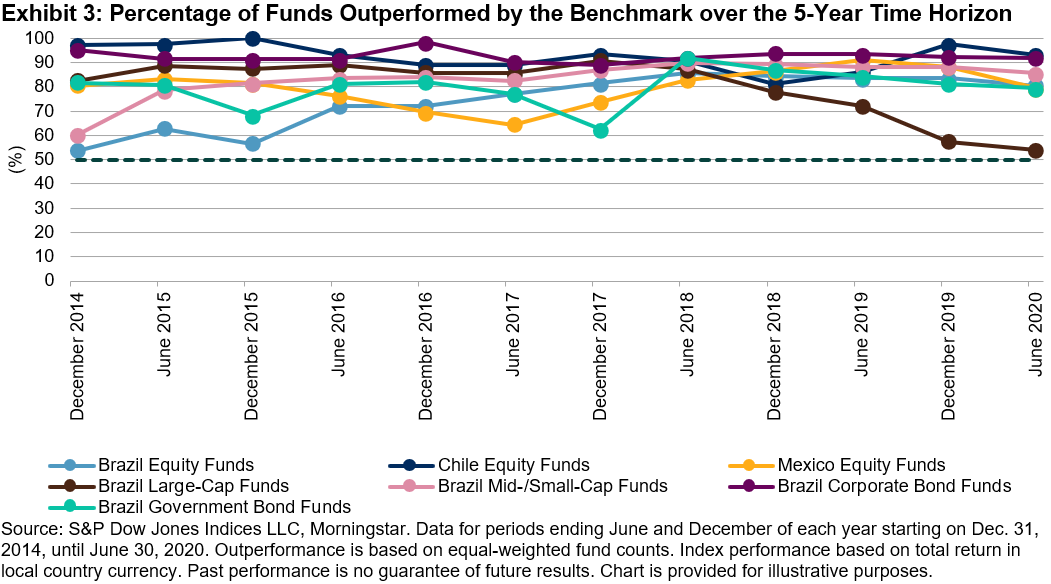

And when considering even longer time periods, like across a five-year period, the majority of active managers in all categories for all three countries were outperformed by their benchmarks.

And when considering even longer time periods, like across a five-year period, the majority of active managers in all categories for all three countries were outperformed by their benchmarks.

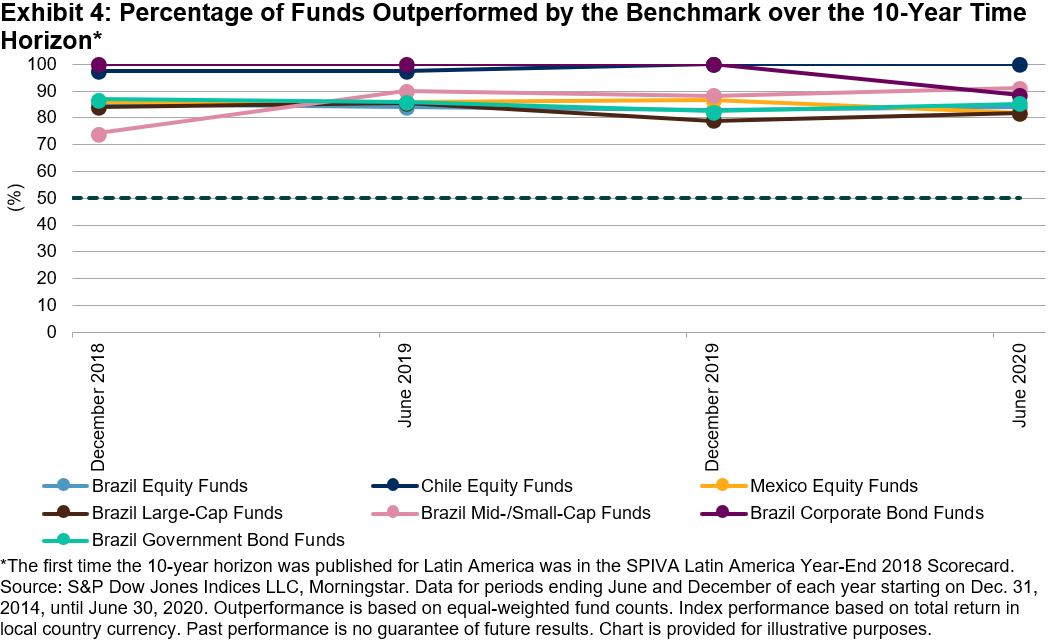

Lastly, for the 10-year period observed, the percentage of funds outperformed by their benchmarks converged in a range above 70%.

Lastly, for the 10-year period observed, the percentage of funds outperformed by their benchmarks converged in a range above 70%.

As evidenced by the SPIVA scorecards, the majority of active managers underperform most of the time, especially across long-term horizons, demonstrating how difficult is to consistently beat the benchmark.

As evidenced by the SPIVA scorecards, the majority of active managers underperform most of the time, especially across long-term horizons, demonstrating how difficult is to consistently beat the benchmark.

1 Index Dashboard: Dispersion, Volatility & Correlation: January 2020; February 2020; March 2020; April 2020; May 2020; June 2020.

The posts on this blog are opinions, not advice. Please read our Disclaimers.