The search for strategies that identify risks and growth opportunities with a motivation in sustainable investing has never been higher for emerging markets. Environmental, social, and governance (ESG) investing provides a way for investors to go above and beyond traditional financial considerations by focusing on a variety of impactful topics relevant to corporations. These topics include how companies interact with their employees, the communities they operate in, their commitment to the environment, and how they encourage change and innovation, to name a few.

The rapid growth and relevance of sustainable investing over the past years has made it a cornerstone in the investment selection process, so the presence of a broad ESG benchmark for the largest market in Latin America was necessary. Aimed toward ESG-oriented investors, S&P Dow Jones Indices launched on Aug. 31, 2020, the S&P/B3 Brazil ESG Index, an ESG-weighted index following a straight set of rules suitable for the Brazilian market, with a focus on sustainability and ESG principles similar to those of the S&P 500® ESG Index.

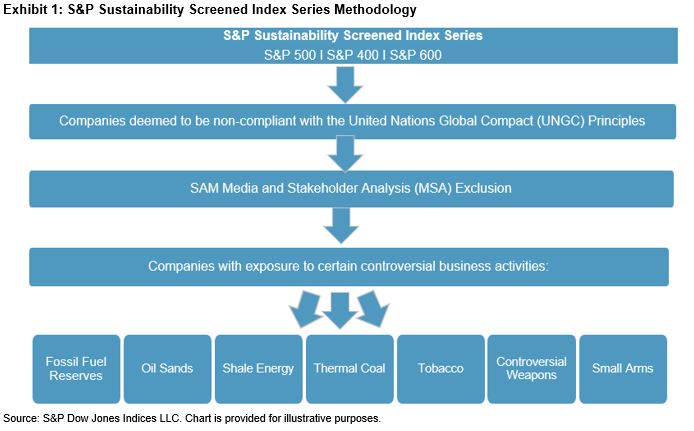

Using the S&P Brazil BMI as its underlying index, companies are excluded based on the following criteria:

- Business activities related to tobacco, controversial weapons, and thermal coal;

- United Nations Global Compact (UNGC) non-compliance;1

- S&P DJI ESG Score; and

- Media and stakeholder analysis controversies.

In the most recent rebalance on April 30, 2020, the resulting universe consisted of 96 constituents.

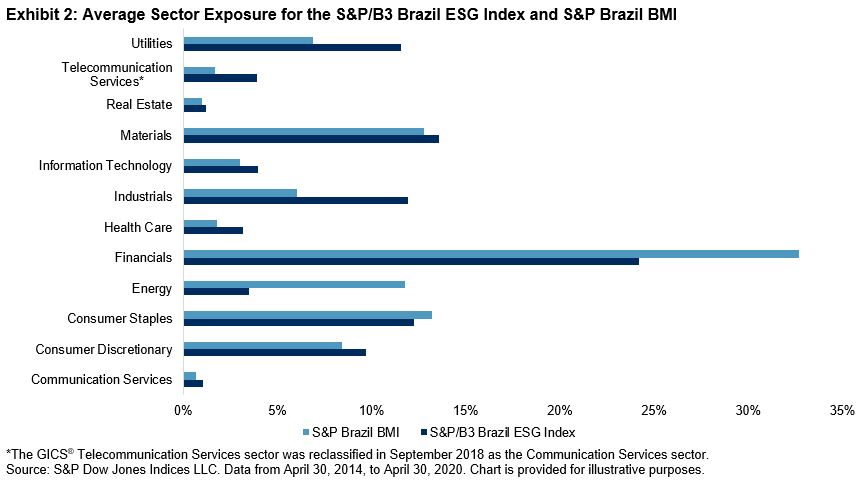

Companies are weighted by ESG score, which is subject to a liquidity cap aimed to improve liquidity. During the April 2020 rebalance, examining 25% of the past six months’ median value traded shows that a BRL one billion ticket can be traded on average in less than one day. In addition, average sector exposure decreased for Consumer Staples, Energy, and Financials. In contrast, all other sectors’ exposure increased.

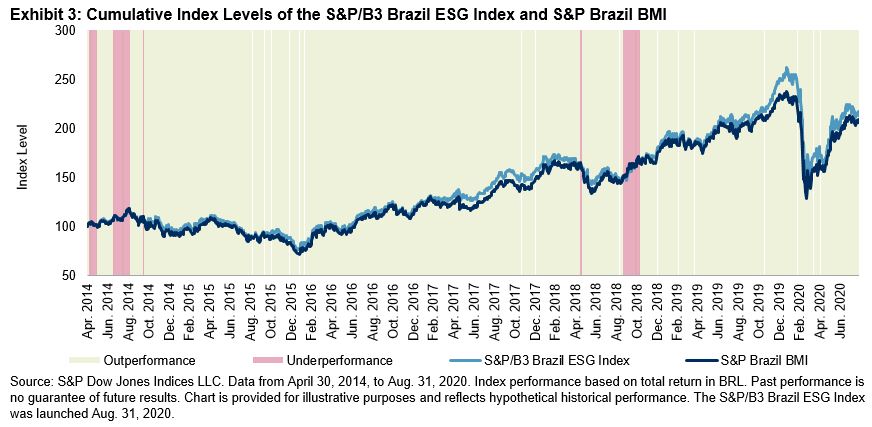

The index moves similar to its benchmark and exhibits an average annualized beta of 0.9 and annualized tracking error that oscillates around 6%. In March 2020, the S&P/B3 Brazil ESG Index experienced an increase in beta and tracking error, displaying a beta close to 1 and a 6.5% tracking error due to the COVID-19 pandemic, when global markets suffered large losses. We can see this movement in the cumulative level chart in Exhibit 3 at the end of Q1 2020. It is relevant to highlight that the strategy not only achieved a risk/return profile similar to that of the S&P Brazil BMI, it also outperformed in more than 90% of the historical observations.

From an ESG perspective, the S&P/B3 Brazil ESG Index was able to improve its ESG score relative to that of the S&P Brazil BMI. During its most recent rebalance, the overall ESG score of the S&P/B3 Brazil ESG Index increased from 47.9 to 57.7, an improvement of 9.8 points; considering that the maximum attainable ESG score of any strategy using the S&P Brazil BMI is 95.9, the ESG realized potential was 20.4%.

Overall, the S&P/B3 Brazil ESG Index is designed to be an alternative for investors that are looking for exposure to the broad Brazilian equities market while maintaining a focus on responsible investing, without losing the benefits of performance and liquidity.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

In addition to these key business involvement screens, companies are also assessed based on their compliance with the principles of the U.N. Global Compact.3 Companies that do not act in accordance with the associated standards, conventions, and treaties are ineligible for the index. The addition of this screen allows for the index to account for companies with violations linked to human rights, labor, environment, and corruption abuses.

In addition to these key business involvement screens, companies are also assessed based on their compliance with the principles of the U.N. Global Compact.3 Companies that do not act in accordance with the associated standards, conventions, and treaties are ineligible for the index. The addition of this screen allows for the index to account for companies with violations linked to human rights, labor, environment, and corruption abuses.