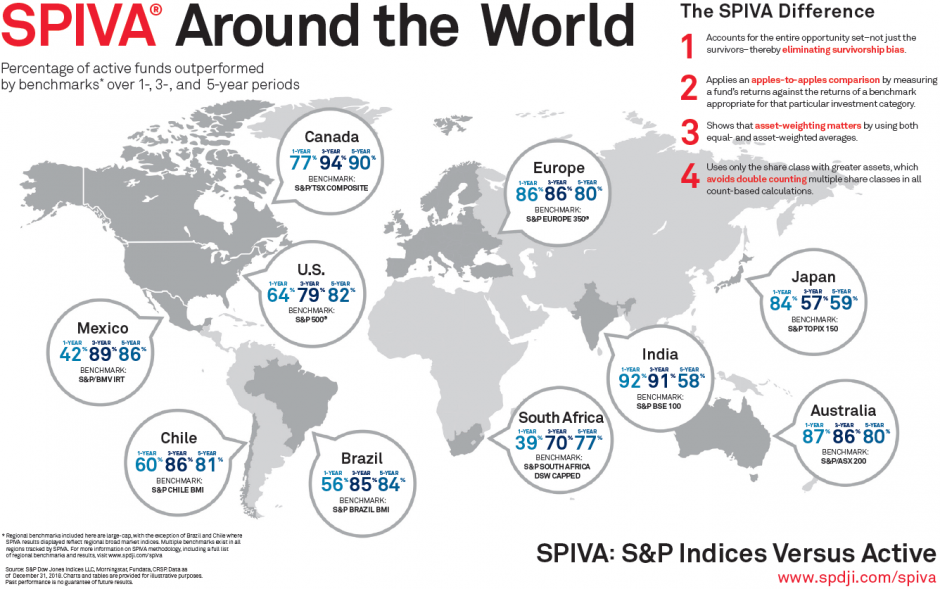

Passive investment is emerging as the more viable and favorable option over active investing. Recommendations for passive investing are supported by statistics. The S&P Dow Jones Indices SPIVA® Around the World Report for year-end 2018 (see Exhibit 1) highlights the trend of benchmark indices beating active funds.

Exhibit 1: SPIVA Year-End 2018 Results

Source: S&P Dow Indices LLC. Data as of Dec. 31, 2018. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

In India’s significant growth economy, with lower inflation, higher GDP, and a robust financial market, there is recognition that the number of large-cap active funds underperforming their benchmark index is growing. The SPIVA India Year-End 2018 Scorecard revealed that 92% of large-cap funds underperformed the S&P BSE 100 over the 1-year period, 91% underperformed over the 3-year period, and over 50% underperformed over both the 5- and 10-year periods. The challenge for active fund managers to deliver superior returns is on the rise.

| Exhibit 2: Percentage of Funds Outperformed by the Index | |||||

| FUND CATEGORY | COMPARISON INDEX | 1-YEAR (%) | 3-YEAR (%) | 5-YEAR (%) | 10-YEAR (%) |

| Indian Equity Large-Cap | S&P BSE 100 | 91.94 | 90.59 | 57.55 | 64.23 |

| Indian ELSS | S&P BSE 200 | 95.45 | 88.10 | 40.54 | 51.52 |

| Indian Equity Mid-/Small-Cap | S&P BSE 400 MidSmallCap Index | 25.58 | 56.52 | 39.68 | 55.26 |

| Indian Government Bond | S&P BSE India Government Bond Index | 81.58 | 71.43 | 88.00 | 96.43 |

| Indian Composite Bond | S&P BSE India Bond Index | 94.44 | 90.97 | 96.64 | 83.33 |

Source: S&P Dow Jones Indices LLC, Morningstar, and Association of Mutual Funds in India. Data as of Dec. 31, 2018. Past performance is no guarantee of future results. Table is provided for illustrative purposes.

Investors are adopting new dynamic approaches to portfolio management in order to align themselves with targeted portfolio goals. Passive investment objectives are driven by strategy and risk/return profiles.

The passive strategies to select from are manifold: value, growth, fundamental, technical, dividend, indexing, tactical, core, satellite, etc. Asset allocation in the strategy seeks to balance risk and reward by assigning the ideal weights of assets in the portfolio to meet the requirement of the end objective. Strategies vary along a spectrum, from aggressive to conservative.

The selection made on the risk/reward spectrum determines the strategy. Reward, or return, is the change in the value of the investment measured in percentage or in absolute terms like appreciation in stock price or receipt of dividends. Risk is measured by standard deviation, which expresses the volatility of the stock or portfolio by variance from the average. If an investment portfolio has an average expected return of 12% with standard deviation at 5%, the range of returns is expected to be between 7% and 17%.

Modern Portfolio Theory (MPT) is a preferred strategic tool that uses diversification to select a group of assets that offer maximum return for a given level of risk. Harry M. Markowitz in 1952 famously explained the relationship of risk and reward through his article “Portfolio Selection” in the Journal of Finance. He became the pioneer of MPT, also referred to as the Markowitz model.

MPT assumes that investors are generally rational and risk averse. The time horizons for risk and return are the same. The views on risk measurement are identical for all investors and they control risk by diversifying their holdings. The investor prefers to either maximize his return for minimum risk or maximize his portfolio return for a given level of risk.

The theory compares two portfolios with the same return expectation, but one has lower risk than the other. MPT shows that the preference is for the portfolio with lower risk. MPT also clarifies that diversification reduces the portfolio risk. MPT supports the case for the passive investing. This style inherently provides a diverse basket of stocks, avoiding concentration risk and offering returns at the chosen risk level.

Standard deviation typically is used to help evaluate investment risk options. If an index offers a lower standard deviation than an active strategy, but with a comparable average return, the choice of preferable investment option should be easy.

A range of indices offer varied strategies across geographies, asset classes, themes, and factors. Index methodologies are transparent and rules based, staying true to style, unlike active management, which can use discretion in striving to achieve objectives. Passive investing is also generally lower in cost, owing to lower fund management fees and ease of trading, as the index constituents trade on the stock exchange like regular equity stocks.

The Indian passive investment industry is gaining strength with over USD 16 billion in assets. Core satellite strategy can facilitate the co-existence of both active and passive styles to meet portfolio goals.

The posts on this blog are opinions, not advice. Please read our Disclaimers.