It is encouraging and inspiring to see that organizations and professional bodies are willing to roll up their sleeves and help for a good cause. The good cause in this case is financial literacy, and the organizing body was the New York Public Library during their semi-annual Financial Planning Day on October 23rd.

McGraw Hill Financial (MHFI), the parent company of S&P Dow Jones Indices, supports the New York Public Library’s Science, Industry, and Business Library (SIBL) in their Financial Literacy campaign. MHFI’s Corporate Responsibility and Sustainability team Co-Sponsored this event with the Financial Planning Association (FPA) of New York. More than a dozen other organizations participated with volunteers and information for attendees. Counselors from FPA NY, Community Service Society of NY, and the Health Insurance Information and Counseling and Assistance Program were on hand to provide advice. MHFI was asked by the organizers to provide an information session to attendees on how indexing works.

To do that, I invited Dr. David Blitzer, Chairman of our S&P DJI Index Committees, and Todd Rosenbluth, Head of ETF and Mutual Fund Evaluation at S&P Capital IQ, to collaborate and present on this topic together. Our approach was to combine index education from S&P DJI with fund education from S&P Capital IQ to help the audience better understand some of the investment choices they might find in everyday life such as investing with funds in an Individual Retirement Account (IRA) or through a 401K plan. Here are some of the key points that David and Todd communicated:

Dr David Blitzer, S&P DJI:

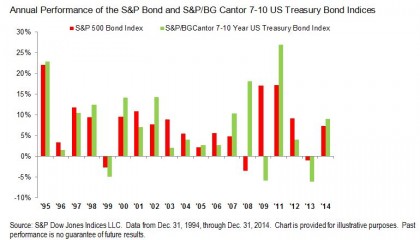

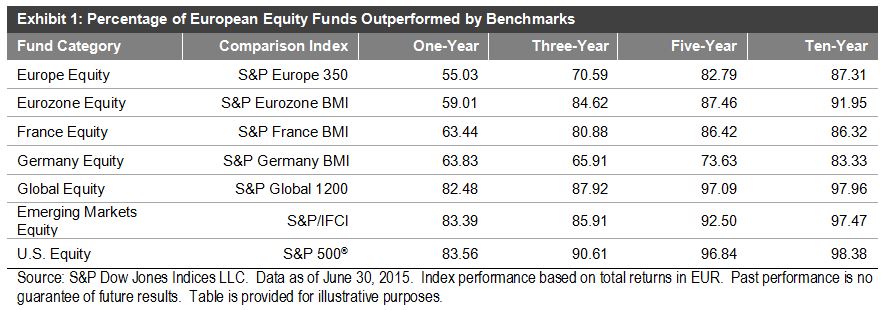

- Historically, over any period of a year or more, about 2 out of 5 mutual funds outperform and three of five underperform their benchmark

- Good performance does not persist for many active mutual funds – our data has shown a 40% chance of beating an S&P benchmark in 1 year, 16% for two years in a row, 6% in three consecutive years

- Why? Index products typically have lower fees than active products – better to keep as much of your money as you can, not give it away to manager fees.

Todd Rosenbluth, S&P Capital IQ / SNL:

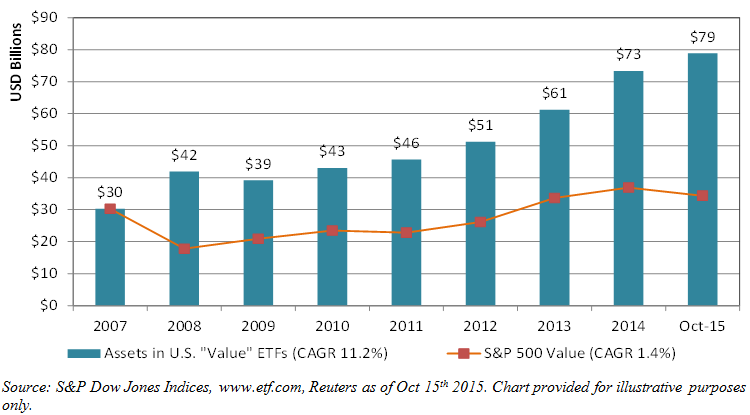

- Finding actively managed funds that outperformed the S&P 500 index over the short and long term is hard. This is why investors pulled $150 billion out of active mutual funds and ETFs in the 12 months ended September 2015 and added $461 billion to passive products according to Morningstar data.

- Those that want active management should seek out funds with a below-average expense ratio and an experienced management team, and that have generated strong returns with below average volatility.

- If investors do their homework they may reduce the likelihood of holding a below-average fund, but it may still end up in their portfolio.

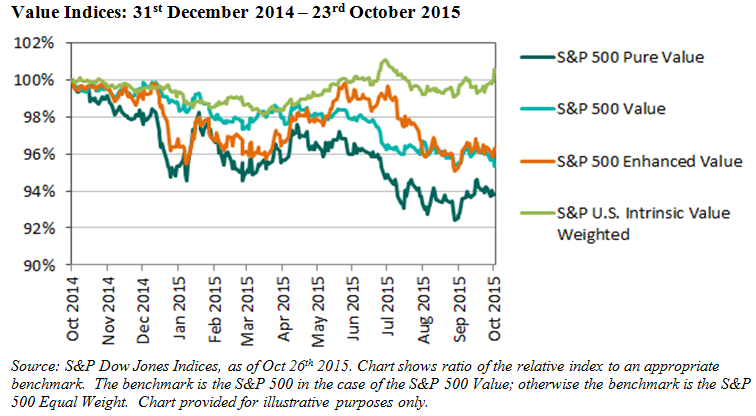

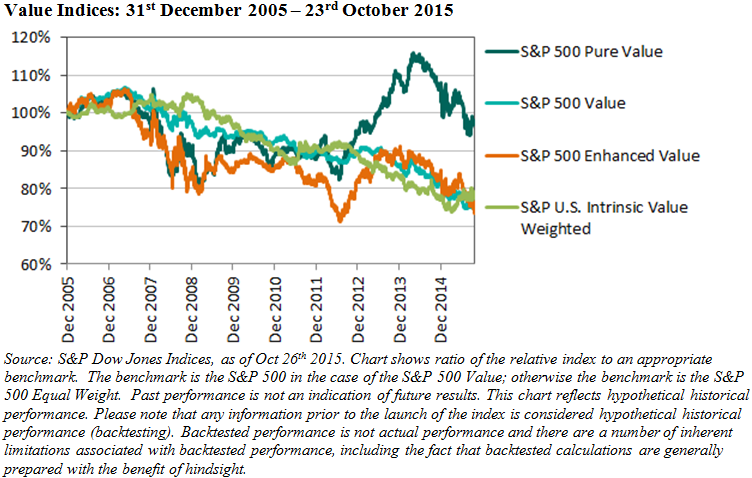

The audience of 75 was interested, attentive, and asked very good questions, such as “why use an equally weighted index rather than the S&P 500?” and “Can an index keep pace with rapidly adopted innovations in an economy, or is it too passive to do that?” David and Todd answered all questions and stayed afterwards with attendees who lined up to ask more questions.

The posts on this blog are opinions, not advice. Please read our Disclaimers.