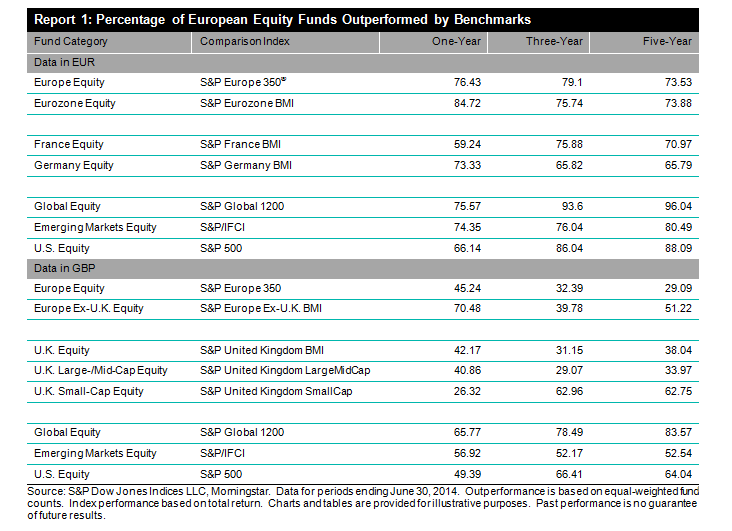

Euro-Denominated Equity Funds

Overall, European equity markets have continued their upward trend over the past year, despite geopolitical concerns in Ukraine and uncertainty over the ECB’s willingness to support struggling economies. It is generally believed that active management may be able to add value to investment portfolios in highly turbulent markets such as this one. However, this belief was once again found to be inconsistent with our findings.

Over the past year, about 74% of European and Eurozone equity funds did not beat their benchmarks and among all fund categories examined, the worst performing were funds invested in global markets. More than 96% of them underperformed their respective benchmarks over a five-year period.

GBP-Denominated Equity Funds

As in the SPIVA® Europe Year-End 2013 report, active GBP-denominated funds invested in U.K. equities delivered the best performance. Over a one-year period, most U.K. funds performed better than their benchmarks. However, this tremendous performance was not repeated in the international fund categories. Most global, emerging market and U.S. active funds underperformed their respective benchmarks over one-, three- and five-year time horizons.

Read the Report

Watch the Video

The posts on this blog are opinions, not advice. Please read our Disclaimers.