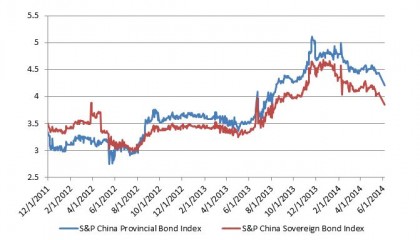

As with each summer’s fashion a new color of dress becomes the “new black”. Pink, green, orange, you make the choice. In regard to the bond markets the question could be is 3% the new black? Bill Gross seems to think so, he is calling for economic growth and yields to remain slow and low, not returning to the levels seen prior to 2008. Global central banking monetary policy has been highly accommodative. Actions last week seem to support Mr. Gross’s view as the European Central bank followed through with a much expected cut in rates moving the benchmark rate from 0.25% to 0.15% and the Deposit facility from 0% to -0.10%.

Last week provided plenty of information and enough commentary to heat the debate of the direction of interest rates. The reaction to German unemployment, unwinding of shorts and the expectations for an ECB rate cut that brought the US 10-year down to a 2.40% just prior to month end eased as rates have crept back upwards. The yield of the S&P/BGCantor Current 10 Year U.S. Treasury Index started the week at a 2.53% and continued upward to a 2.60%. Currently 2.6% is 40 basis points below the beginning of the year’s 3%.

The U.S. economic calendar for this week starts tomorrow with Wholesale Inventories for April expected at a 0.5% versus the prior 1.1%. Wednesday’s MBA Mortgage Applications (-3.1% prior) and Thursday’s Retail Sales (0.6% expected), Initial Jobless Claims (310k exp.) and Business Inventories (0.4% exp.) will all be announced. Friday will close the week with May’s PPI (0.1% exp.) and the University of Michigan Confidence from which an 83 is expected, up from the prior 91.9.

The search for yield has put a spotlight on the higher yielding credits like senior loans and high yield bonds but what about investment grade credits? The demand for corporate bonds has been very high and corporate issuers have met demand as mentioned in Tim Sturrock’s article Global Fixed Income Investors Flock to Corporate Bonds. According to Tim, “corporate bonds in particular, are drawing the bulk of new assets, while government bond strategies are bleeding assets.” The S&P U.S. Issued Investment Grade Corporate Bond Index has returned 4.75% year to date.

After lagging the year-to-date total return of investment grade corporates, the S&P U.S. Issued High Yield Corporate Bond Index surpassed its investment grade counterpart by closing the week with a return of 4.89% YTD. New Issuance by names such as Advanced Micro Devices, Cascades Inc., DFC Finance, Outerwall, Polymer Group and TRI Pionte Homes having fed the demand for high yield paper.

The S&P/LSTA U.S. Leveraged Loan 100 Index returned 0.16% month-to-date and now has returned 2.08% for the year. Issuance totals mounted quickly this week as borrowers eyed climbing rates ahead of potentially abetting inputs from ECB policy. A total of 23 issuers placed roughly $26 billion of new supply from Monday to Wednesday, with slower conditions expected late in the week.

The S&P U.S. Preferred Stock Index (TR) was down for the week and the start of the month returning -0.65%. The year-to-date high of 9.86% reached on May 19th has shrunk to 9.68% while strength in the equity markets may have seen investor reallocating funds as the year-to-date return of the S&P 500 has gone from 2.8% to 6.43% over the same time frame.

Source: S&P Dow Jones Indices, Data as of 6/6/2014, Leveraged Loan data as of 6/8/2014.

The posts on this blog are opinions, not advice. Please read our Disclaimers.