When I see a forecast of freezing weather, unlike most, I don’t think about how I will dress warmly or prepare for the cold. As a commodity lady, I think about how much the price of natural gas will increase. However when I saw this on TV yesterday, I had more food for thought than just the price of natural gas. Notice Friday’s high is listed as 18 degrees Fahrenheit (about -8 Celsius) while the low is listed as 19 degrees Fahrenheit (about -7 Celsius).

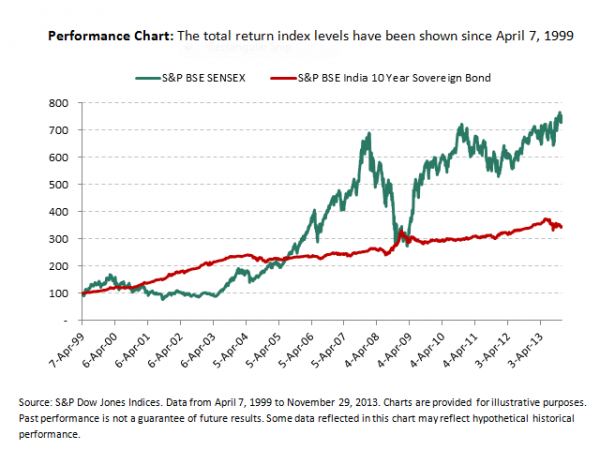

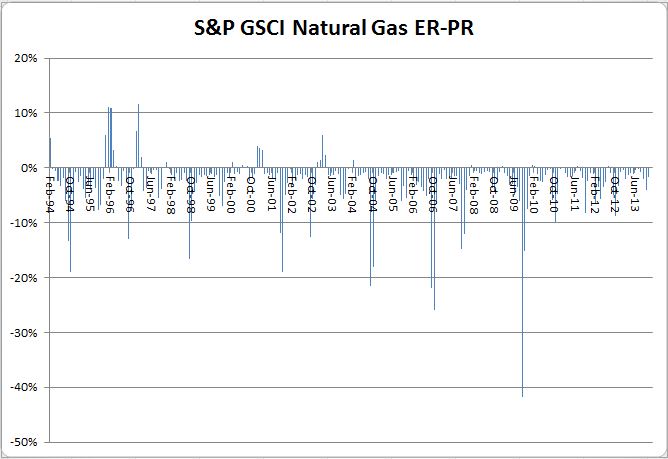

I only chuckled for a moment before thinking about natural gas again. Natural gas has been the best performing commodity in the S&P GSCI so far in 2014, up 8.6%. It is also in backwardation with the spot only up 7.6%, which is relatively rare. You can see in this chart below that natural gas has been in backwardation in only 13% of months since 1994. Also, it has only been in backwardation in 10 months within the past 10 years with an average premium of 39 basis points. That is about 60 basis points less than the premium thus far in January 2014. What is less unusual about the backwardation is its January appearance since backwardation has always happened in extreme cold or heat.

Since 1995, there have been 8 positive January months with an average return of 9.1%. The highest return in January was in 2007, when the S&P GSCI Natural Gas returned 21.7%. Although there was a slightly positive return in 2008 of 34 basis points, 2014 has the first significant positive return since 2008, 6 years ago, when the monthly return was 7.9%. Please see the chart below:

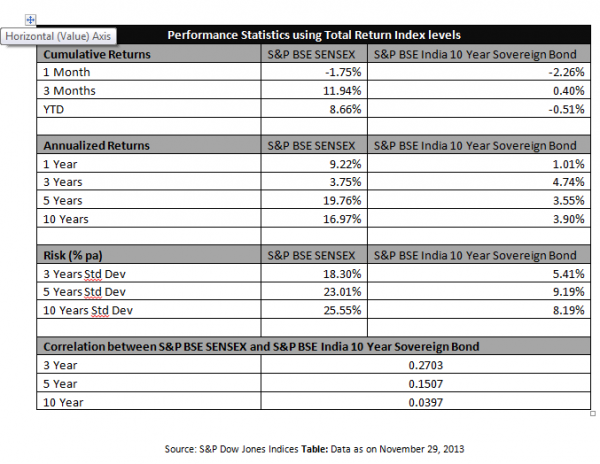

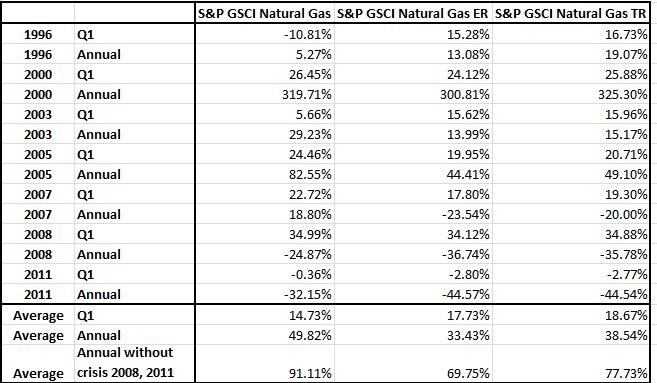

The question is what has happened following a positive January for natural gas? In years with positive January months, average first quarter returns were 14.7% for the spot index and 18.7% for the total return. Average annual returns were 49.9% for spot natural gas and 38.5% for the total return, but without the crisis years, the average annual return was double.

Please see the table below:

The posts on this blog are opinions, not advice. Please read our Disclaimers.