For what risk does the commodity investor get paid? At what point is the fear gauge so high the risk gets passed like a hot potato? The answers to these questions will help explain why post the global financial crisis there has been a link between VIX spikes and commodity losses.

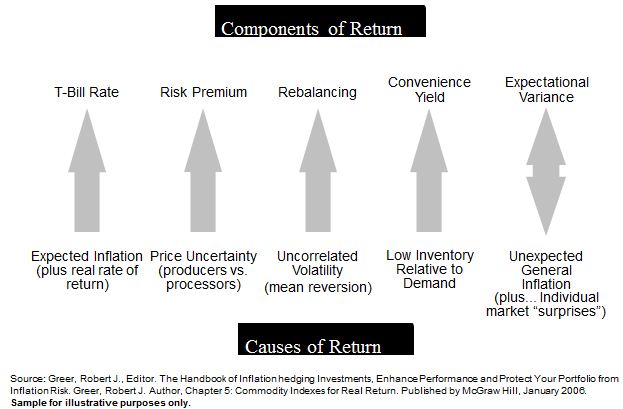

Let’s address the first question of what risk the commodity investor takes to be compensated. While there are five fundamental sources that drive the commodity asset class returns, the insurance risk premium is a major source of return and is the one behind the VIX – commodity link. Please see below for the chart of fundamental sources and components of commodity returns and click here to hear more about them in an educational slideshow.

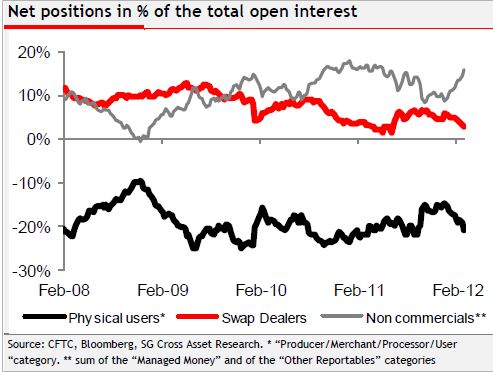

The insurance risk premium is available to long-only commodity investors since there is a gap that needs to be filled between producers and commercial consumers that are hedging. Remember, the futures markets exist to facilitate hedging, not to forecast prices. The producers go short to protect against price drops and the consumers go long to protect against price increases. However, the producers need protection against price drops more than consumers need protection against price increases. The reason this is the case is supported by two economic theories: 1. Hicks’ theory of congenital weakness that argues it is easier for consumers to choose alternatives so they are less vulnerable to price increases than producers are to price drops, and 2. Keynes’ theory of “normal backwardation” that argues producers sell commodities in advance at a discount which causes downward price pressure, which converges to the spot at the time of delivery. This results in net short hedging pressure from physical users as shown in the graph below:

This leads us to the second question, “At what point is the fear gauge so high the risk needs to be passed like a hot potato?”

As published in a white paper by Cheng et al., while in normal times, or in other words “pre-crisis”, commodity investors accommodate the needs of commercial producers by providing the aforementioned insurance by taking the long side of the futures contracts that the commercial consumers forego. However, in times of financial distress, or “post-crisis”, commodity investors reduce their net long positions in response to an increase in the risk as measured by VIX, causing the risk to flow back to the hedgers.

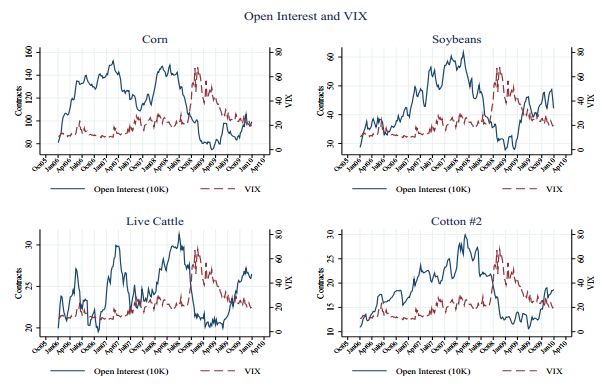

What is happening, as Tang and Xiong argue, is that although the risk sharing improves as the presence of commodity index traders increases, the expense of risk spillover from outside markets increases. Simply stated, the risk for investors to provide insurance becomes too high to bear. Like the convection of a current of air that flows from a high-pressure area to a low-pressure area, the risk flows from the more distressed commodity index investors to the less distressed hedgers – beginning the game of “hot potato” since no one wants to hold the risk. The result is a collapse in open interest as shown in Cheng’s paper in the table below.

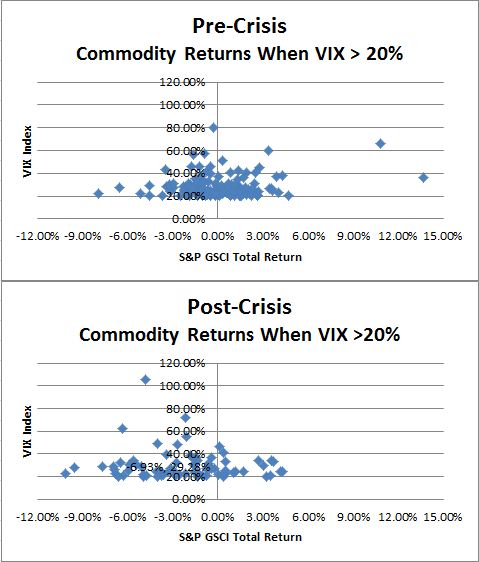

How does this translate into linking VIX spikes to commodity dips? Using weekly return data on a rolling basis daily back to January 1990, of a total of 215 times that VIX spiked more than 20%, 142 occurred prior to Sept 2008 and 73 occurred after Sept 2008. In the pre-crisis, of the 142 times that VIX spiked >20%, commodities fell 82 times or 58% of the time with an average return of 6 basis points during the weeks of VIX spikes. However, the post crisis number of weeks on a rolling basis where VIX spiked >20% was 73 and commodity returns were negative 65 of those times or 89% with an average return of -3.4%. Please see the charts below that demonstrate this:

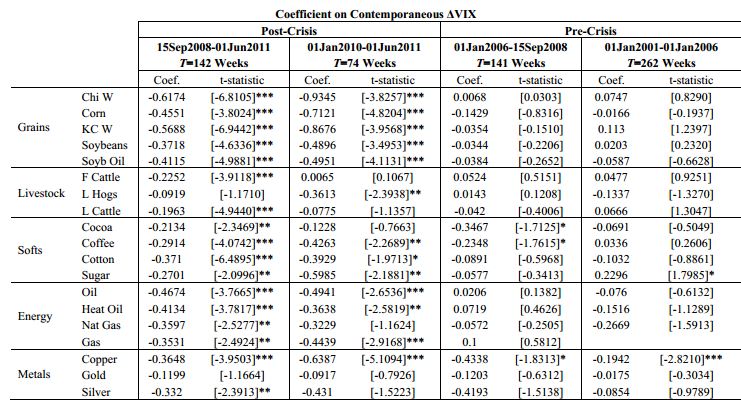

A similar result holds when examining commodity returns for the week following a VIX spike >20%. Pre-crisis returns were 0.00% and post-crisis returns were -2.2%. Cheng’s paper finds a similar result for individual commodity futures markets via regression analysis as shown below:

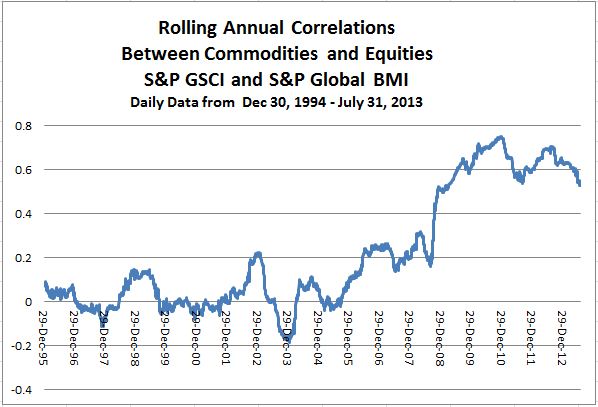

In conclusion, something to watch as an indicator of when the risk on – risk off environment might end this game of hot potato may be how the quantitative easing and policy drive the correlations between commodities and equities, which seem to have peaked, but not so obviously to declare game over yet.