It doesn’t take more than a passing glance at a business publication or televised market update to know that one of the top business stories is the current low interest rate regime. U.S. Treasury bills are being auctioned, and are trading, at or near zero yields. The yield-to-worst on the S&P/BGCantor 0-3 Month U.S. Treasury Bill Index is presently at 0.03%. This means the government is financing itself at close to zero cost for its short term borrowing and, further out on the curve, the cost of financing does not go up by much; as the yield-to-worst on the S&P/BGCantor 7-10 Year U.S. Treasury Bond Index is now at 1.48%. As long as the Fed continues to effectively stimulate monetary policy with its monthly purchases of $85 billion in notes and mortgage bonds, this situation will most likely continue.

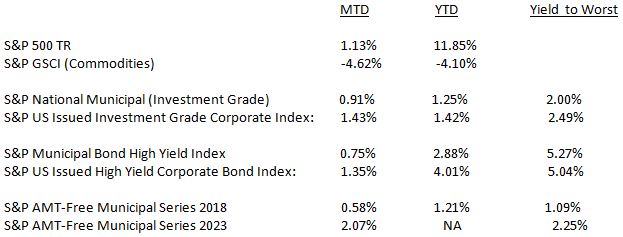

As the treasury curve is the basis of valuation for most debt, outside of Libor for loans and swaps, the currently advantageous environment applies to other asset classes of the capital markets as well. Corporate debt, as measured by the S&P U.S. Issued Investment Grade Corporate Bond Index, has reached recent lows in May as the index’s yield-to-worst stands at 2.50%. Below investment grade issuers, whose credit risks rating agencies view as a higher concern, and which comprise the S&P U.S. Issued High Yield Corporate Bond Index, are yielding 4.66% (YTW).

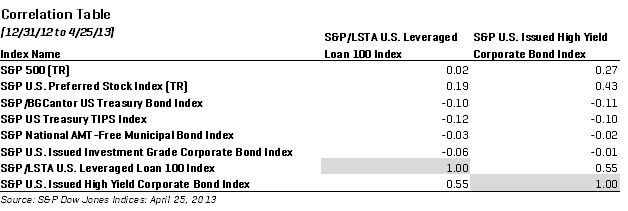

Treasurers and CFOs across the market are touting this as the perfect time to refinance and strike deals, as the cost of financing is so low. Companies are issuing various maturities of debt at a frenzied pace to an investor base that demands as much yield as it can get. Such “oversubscribed” deals show that investors are piling into both investment grade and high yield paper. Investors are frantically scooping up any product that provide yield, but are they turning a blind eye to the risks they are assuming? As companies use these funds to realign their businesses, pay down older debt, start new projects, or create new ones, the benefits of current leveraging will only be determined in the future. A more immediate effect, among others, has been the buyback of equity shares by a number of companies, as the S&P 500 is up 14.06% year-to-date.