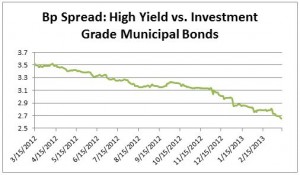

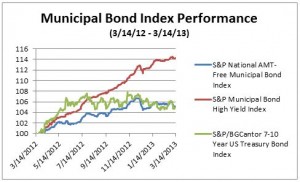

High yield municipal bond yields and relative spreads to investment grade munis have moved to lows not seen since 2008. The S&P Municipal Bond High Yield Index has shown a positive total return of over 1.68% year to date and over 14% since this time last year. The yield spread between high yield and investment grade municipal bonds is now at 265bps or 2.65% (on March 15, 2012 the spread was 351bps).

Investment grade municipal bond yields have moved up and prices down two weeks in a row. These have not been big moves but moves to downside in any event. Barely in positive territory, investment grade tax-exempt bonds tracked in the S&P National AMT-Free Municipal Bond Index have returned a positive 0.11% ytd. The weighted average yield to worst for bonds in this index is a 2.14% or about 9 basis points cheaper than the end of the previous week. The yield to worst results in a Taxable Equivalent Yield of 3.29%. The Dow Jones Corporate Bond Index is yielding 2.62% to worst, so municipal bonds are remaining incrementally higher yield than their counterparts in the corporate bond market.

Comparing returns of municipal bonds to other asset classes:

Index: YTD Returns:

S&P 500 (TR) 10.14%

S&P GSCI (TR) -0.19%

S&P National Municipal 0.11%

S&P Municipal High Yield 1.68%

S&P/BGCantor US Treasury 7 – 10 Yr -1.33%

Taxable Equivalent Yield based on a 35% marginal tax rate

The posts on this blog are opinions, not advice. Please read our Disclaimers.