Every year in India, the Finance Minister presents the Union Budget, which is perhaps the most important economic activity in the country. “Budget Day” comes with a lot of expectations, and it therefore has a bearing on the capital markets in both the pre- and post-budget sessions. The days before and after the budget session usually bring volatility to the capital markets.

With “Budget Day” just around the corner, attention is turning to the Finance Minister as he gears up to announce the last budget of this administration on Feb. 1, 2019. This will be considered an “interim budget” rather than a regular budget because India will have national elections in a few months, and the next finance minister gets to make the final decisions after a new administration is formed. The interim budget will be crucial for the government considering the recent debacle in the state elections in December 2018, which may have an impact on the sops that are rolled out in this budget; hence, the people have higher expectations than usual during this budget session.

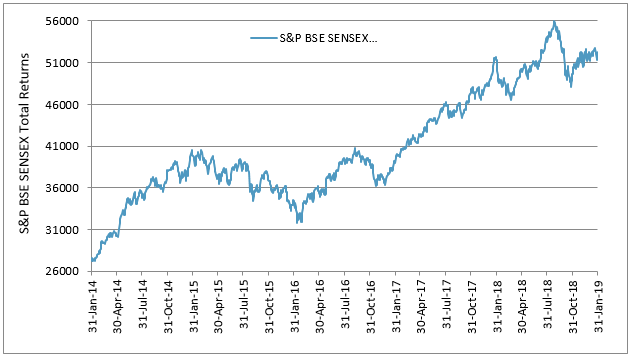

The S&P BSE SENSEX’s total return index value increased from 27,648.13 on Jan. 31, 2014, to 52,335.86 on Jan. 31, 2019, and the highest close was at 55,975.53 on Aug. 28, 2018 (see Exhibit 1). This represents a five-year CAGR of 17.30% for the period.

Exhibit 1: S&P BSE SENSEX Total Return

Source: S&P Dow Jones Indices LLC. Data from Jan. 31, 2014, to Jan. 31, 2019. Index performance based on total return in INR. Past performance is no guarantee of future results. Chart is provided for illustrative purposes

| Exhibit 2: 30-Day Pre- and Post-Budget Day Monthly Returns and Volatility of the S&P BSE SENSEX | |||||

| PERIOD | BUDGET DATE | RETURNS (%) | VOLATILITY (MONTHLY) (%) | ||

| PRE-BUDGET | POST-BUDGET | PRE-BUDGET | POST-BUDGET | ||

| 2014-2015 | July 10, 2014 | -0.28 | -0.22 | 3.97 | 3.68 |

| 2015-2016 | Feb. 28, 2015 | -1.14 | -5.88 | 3.81 | 3.92 |

| 2016-2017 | Feb. 29, 2016 | -6.88 | 7.86 | 5.96 | 5.01 |

| 2017-2018 | Feb. 1, 2017 | 3.88 | 4.36 | 2.51 | 2.41 |

| 2018-2019 | Feb. 1,2018 | 6.39 | -5.27 | 1.99 | 3.92 |

| 2019-2020 | Feb. 1, 2019 | 0.02 | NA | 3.28 | NA |

Source: S&P Dow Jones Indices LLC. Data from June 9, 2014, to Jan. 31, 2019. Past performance is no guarantee of future results. Table is provided for illustrative purposes.

In Exhibit 2, we can see that in most years, the S&P BSE SENSEX witnessed high volatility in the 30-day pre- and post-budget sessions. The highest 30-day pre- and post-budget volatility was observed in 2016. The lowest volatility in the 30-day pre-budget session was seen in 2018.

To conclude, we can say that the budget sessions tend to be volatile for capital markets in India. The pre-budget movement has historically been influenced by market participant expectations for the budget, while the post-budget movement tends to be based on the actual budget presented by the Finance Minister. The budget may be the most important economic activity affecting capital markets in India, and its relevance is captured by the movement of the S&P BSE SENSEX.

The posts on this blog are opinions, not advice. Please read our Disclaimers.