This blog post was co-authored with Dr Richard Mattison, Chief Executive Officer, Trucost, part of S&P Global

On Sept. 25, 2018, Japan’s Government Pension Investment Fund (GPIF)—the world’s largest pension fund—announced its selection of two new low-carbon indices, the S&P/JPX Carbon Efficient Index and the S&P Global Ex-Japan LargeMid Carbon Efficient Index, with an allocation of JPY 1.2 trillion (approximately USD 10.6 billion).[1]

GPIF President Norihiro Takahashi commented, “GPIF hopes that the selected Global Environmental Stock indices will provide an opportunity for companies to work on carbon efficiency and disclosure… Moreover, the indices can include small listed companies that were not covered by other ESG indices, which goes along with GPIF’s idea to improve the sustainability of the overall market… GPIF will continue to actively engage in ESG investment so as to maintain pension reserves for the future generations.”[2]

The broad market approach taken by GPIF presents an interesting case study. The question is, can a traditional passive investment approach help with the transition to a low-carbon economy?

Early indications are positive. Since the launch of these indices, Trucost, part of S&P Global and carbon data provider for the S&P Carbon Efficient Index Series, has seen a 700% uplift in the number of enquiries from companies wanting to understand how their carbon performance is assessed—and how they can improve their performance in the future.

While GPIF’s investment in carbon-efficient indices may be described as passive in style, the team is taking an active approach to market engagement. Just this week, a full capacity audience of 500 companies and investors attended Nikkei’s “Sustainable Development Goals Forum” in Tokyo. GPIF’s president joined the Governor of the Bank of England Mark Carney and Trucost CEO Richard Mattison on stage to outline the importance of the transition to a low-carbon economy. S&P Dow Jones Indices and Trucost highlighted the key components of the S&P Carbon Efficient Index Series.

Governor Carney emphasized the importance of the recommendations from the Taskforce on Climate-related Financial Disclosures (TCFD) and encouraged all companies and investors to assess the resilience of their strategy to different climate transition pathways, using scenario analysis techniques. Many companies at the event described how difficult it was to perform this type of scenario analysis, and Richard Mattison highlighted how new Trucost datasets on carbon price risk will help companies and investors understand how the profitability of their assets will be affected, out to 2030, under a 2 degrees Celsius climate scenario. S&P Dow Jones Indices has also applied this data to create the S&P Carbon Price Risk Adjusted Index Series.

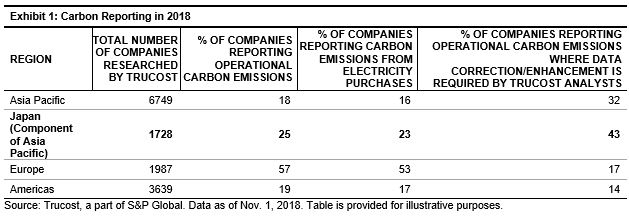

Companies in the Asia Pacific region have traditionally lagged their European and Americas counterparts on carbon reporting, although Japan is already demonstrating significant leadership in the region (Exhibit 1). Of course, in just one month, it is too soon to fully assess the impact of GPIF’s commitment to carbon, but the early signs are promising, and we’ll be paying close attention to the numbers in order to report back on this interesting case study. This engagement with the market by the world’s largest pension fund could lead to significant improvement in disclosure, more efficient markets, and over time, significant carbon emission reductions.

Since the launch of the S&P/JPX Carbon Efficient Index and the S&P Global Ex-Japan LargeMid Carbon Efficient Index, the S&P Global 1200 Carbon Efficient Index, S&P 500® Carbon Efficient Index, and S&P Europe 350 Carbon Efficient Index have been added to the S&P Carbon Efficient Index Series. These indices are now available to all investors.

[1] https://www.gpif.go.jp/en/topics/GPIF%20Selected%20Global%20Environmental%20Stock%20Indices.pdf

[2] https://www.gpif.go.jp/en/topics/GPIF%20Selected%20Global%20Environmental%20Stock%20Indices.pdf

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Source:

Source: