In our previous blog (The Importance of Sector Diversification in a Yield-Focused Strategy – Part I), we highlighted that sector biases in an unconstrained yield strategy could detract from portfolio returns. In this blog, we will show that addressing the sector concentration issue can improve risk-adjusted returns.

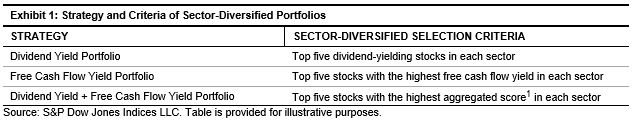

We constructed three sector-diversified portfolios—the dividend yield portfolio, free cash flow yield portfolio, and dividend yield + free cash flow yield portfolio—with each portfolio selecting the top five highest ranking stocks from each sector (see Exhibit 1). Each portfolio was rebalanced on a quarterly basis from December 1990 to December 2017 and weighted equally.

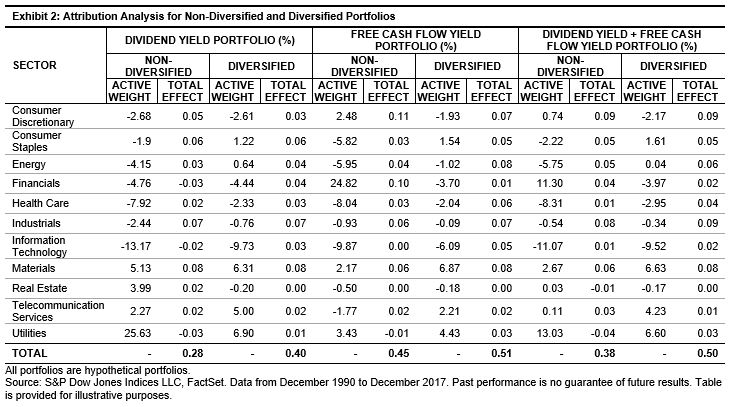

Exhibit 2 shows that, compared with non-sector-diversified portfolios, the sector-diversified portfolios had smaller deviations in active sector weights relative to the underlying broad market. This reduction in sector concentration resulted in higher positive active returns—which is the difference between the total portfolio return and the total benchmark return as measured by the S&P 500® and indicated by total effect. We see the biggest difference in the utilities sector, where the non-diversified portfolios had negative return attributions but the diversified portfolios all displayed positive total effect. In fact, the diversified portfolios showed a positive effect for all sectors in the strategies tested.

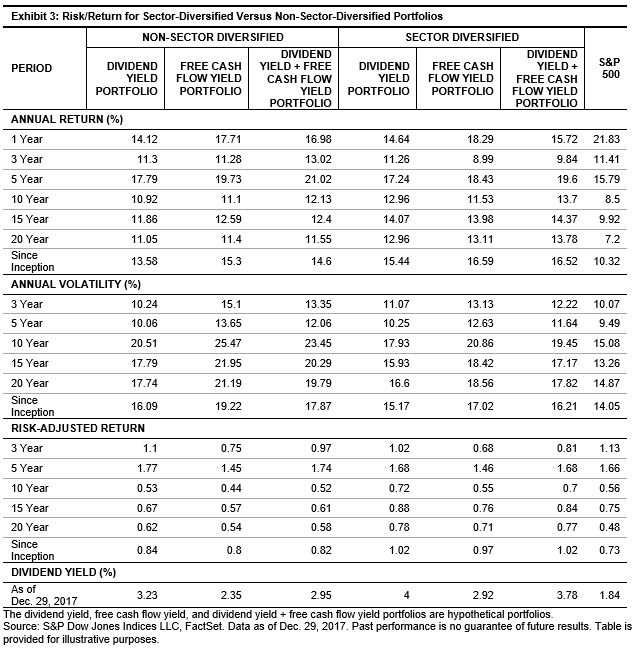

As shown in Exhibit 3, over the long-term investment horizon, the sector-diversified portfolios displayed higher returns and lower volatility than the non-sector-diversified portfolios and the broad market, without sacrificing yield.

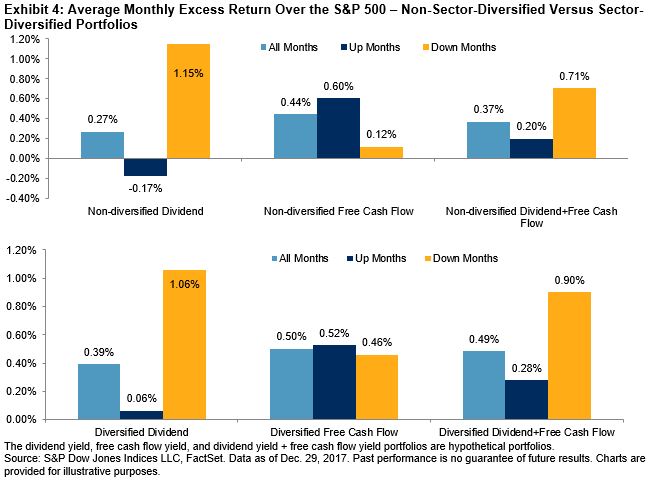

In addition to higher risk-adjusted returns, we also found that sector diversified income portfolios provided larger downside protection than the non-sector-diversified ones. Exhibit 4 highlights the monthly average excess returns of the sector-diversified and non-sector-diversified portfolios over the market, which is represented by the S&P 500. We can see that sector-diversified portfolios, on average, had higher average monthly excess returns than the non-sector-diversified portfolios in most market environments, including down markets.

Our analysis highlights the importance of sector diversification for yield-seeking market participants. Across all three strategies—dividend yield, free cash flow yield, and the combined dividend yield + free cash flow yield—sector-diversified portfolios historically demonstrated higher risk-adjusted returns than the non-sector-diversified portfolios, without compromising yield.

[1] The product of the z-scores of the dividend yield portfolio and free cash flow yield portfolio forms the aggregated score.

The posts on this blog are opinions, not advice. Please read our Disclaimers.