With 2017 in the rear view mirror, we can look back and observe that short VIX strategies rank as one of the most profitable strategies of the year. The S&P 500® VIX Short-Term Futures Inverse Daily Index returned 186.39%, and selling VIX futures has become a popular income-generating strategy. 2017 was also a year marked by an extraordinary level of low volatility. VIX has been hovering around 10 and dipped below 10 more than 50 times; on Nov. 3, 2017, VIX posted its all-time low of 9.14.

Contrary to the traditional “buy low, sell high” investing principle, in VIX trading, low volatility encourages more selling, rather than buying, on VIX futures, which is counterintuitive given the often-discussed, mean-reverting property of VIX.

There are two factors market participants need to consider when confronting this mystery.

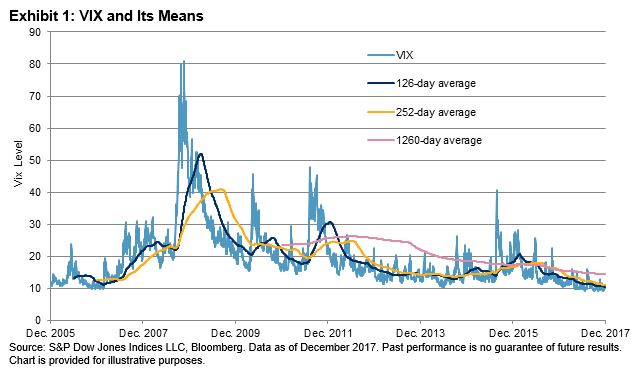

First of all, VIX displays local mean reversion. That is, it tends to return to its short-term local mean, rather than to its long-time average. Exhibit 1 shows VIX numbers, with 126-, 252-, and 1,260-trading-day averages. We can see regime shifts of VIX over its history. The long-term mean (in this case, five-year average) has very little indicative power on the current VIX level. As VIX tends to rise much faster than it falls, in low VIX markets, such as in 2013, 2014, and 2017, the spot may remain below its long-term mean for extended periods.

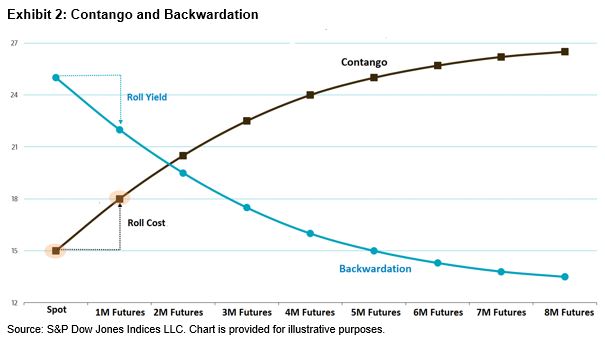

Second, we need to understand that VIX futures indices and their index-linked investment vehicles provide short exposure to VIX futures, not the spot. A key concept for any futures contracts, not just VIX futures, is the futures term structure, since the futures curve shape dictates whether rolling futures over time incurs cost or benefit. Futures are in contango when the futures term structure is upward sloping, meaning the futures prices are more expensive than the spot. Futures are in backwardation when the futures term structure is downward sloping, meaning the futures prices are less expensive than the spot (see Exhibit 2).

Although the VIX spot is somewhat mean reverting, holding a long position in VIX futures over the long term tends to produce losses, because the VIX futures term structure is usually in contango, as market participants generally associate more uncertainty with longer time horizons. However, in a stressed market where immediate risk is perceived by most market participants, the VIX futures curve tends to flip into backwardation.

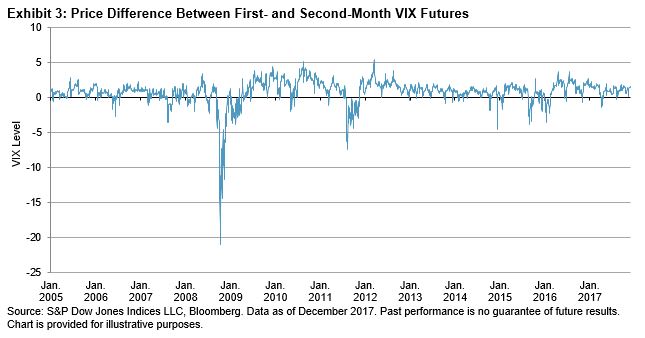

To highlight, we can use the widely followed S&P 500 VIX Short-Term Futures Index as an example. It rolls continuously from the first-month futures to the second month. Exhibit 3 shows the price difference of these two contracts starting on Jan. 3, 2005, calculated as the second-month VIX futures price minus the first-month VIX futures price. Among these 3,272 trading days, contango occurred on 2,718 days (83%) between the first- and second-month VIX futures. Given that approximately 5% of the portfolio is rolled on a daily basis, the average daily roll cost is 29 bps.

This roll cost may seem minor on a standalone basis, but its cumulative impact on VIX futures performance is significant. If VIX remains unchanged for a year, the index can potentially lose about half of its value in the continuous daily roll process.

Therefore, we need to take into account that VIX spot tends to revert to its short-term mean, and the current low volatility environment may persist until a regime shift. When VIX is low and the market is calm, the VIX futures curve tends to be in contango, which encourages shorting VIX futures strategies, as we witnessed in 2017.

The posts on this blog are opinions, not advice. Please read our Disclaimers.