Here are six notable developments in the U.S. financial markets in September 2017.

- Smaller caps outperformed large caps.

- Value outperformed growth.

- Energy was the top-performing sector, and the utilities sector was the worst-performer.

- Developed markets posted gains, while emerging markets lost steam.

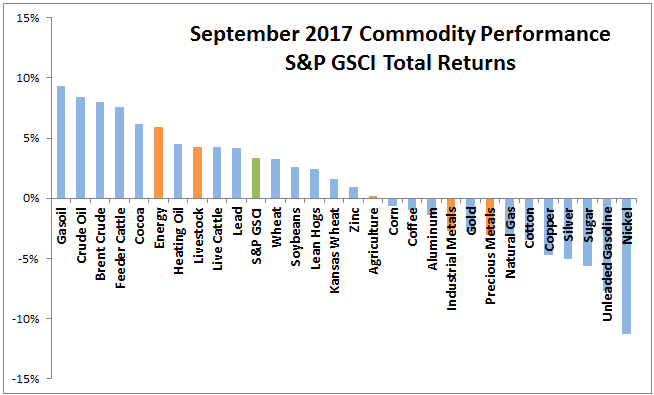

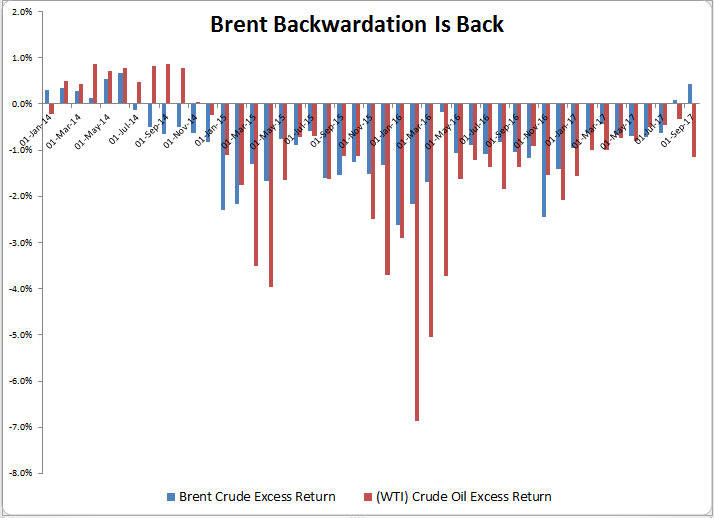

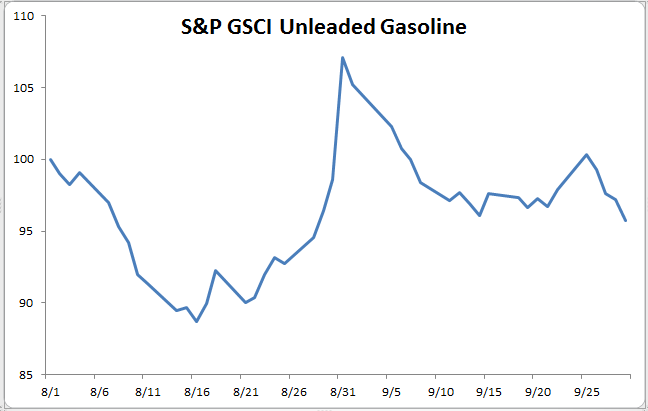

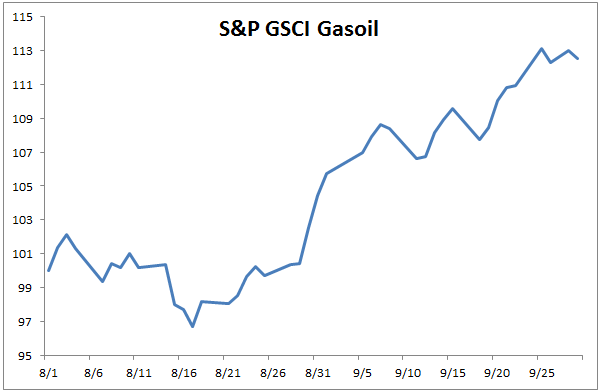

- Commodity indices rebounded, driven by recent strength in energy.

- U.S. 10-year and 30-year Treasury yields rose.

What do these events have in common?

They are all reversals from the January-August 2017 period, where large caps outperformed smaller caps, growth outperformed value, and energy lagged due to weakness in oil compared to the utilities sector, which was the second top performer in August. Meanwhile, emerging markets outperformed developed ex-U.S. markets, while Treasury yields fell.

What was different about September 2017?

The bull market in equities deepened through the cap spectrum. While smaller caps, value, and energy still lag on a YTD basis, the S&P SmallCap 600® was up 8% in September 2017 compared to the S&P 500®’s 2% gain. Similarly, the S&P 500 Value gained 3% compared to the S&P 500 Growth’s 1% gain. Energy made a turnaround as the top-performing sector in September, thanks to the rebound in oil prices, which also drove the gains in the S&P GSCI. Meanwhile, utilities performed poorly in September, declining 3%, a reversal from the prior month, indicating market participants’ return to a risk-on appetite. Emerging markets also stumbled, with the S&P Emerging BMI down 1%.

Is the “Trump” trade making a comeback?

Flash back to November 2016, when the U.S. equity markets and small caps in particular rallied post the U.S. Presidential election, with the S&P SmallCap 600 up 13% that month, while emerging markets declined. Treasury yields rose, while energy posted gains and the utilities sector was the worst performer. The S&P 500 Value gained 6%, outperforming the S&P 500 Growth’s 1% gain.

November 2016’s market performance sounds eerily familiar to that of September 2017. We would argue that these themes are not six independent things—they are six different manifestations of one “big thing”. That “big thing” is the perception that the U.S. economy is strong and poised to continue growing at a rapid clip. One of the drivers of this perception is the possibility of growth-oriented tax reform, which will aid in boosting companies’ earnings and thereby solidify market fundamentals.

Will the coming months offer a continuation of these trends? We caution that predicting market outcomes is challenging given the many geo-political uncertainties at stake. Time will tell.

The posts on this blog are opinions, not advice. Please read our Disclaimers.