On Sept. 7, 2017, RobecoSAM and S&P Dow Jones Indices (S&P DJI) announced the results of the annual rebalancing of the Dow Jones Sustainability Indices (DJSI). This year, a record of 942 companies (up 9 %) from around the world that had participated in RobecoSAM’s annual Corporate Sustainability Assessment (CSA) eagerly waited to learn whether they had been included in one of the most prestigious indices.

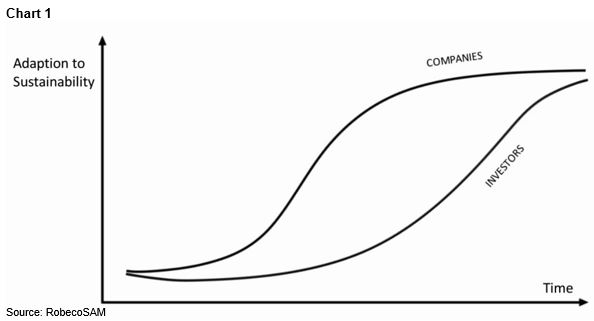

Over time, these indices have evolved into something much more than just benchmarks for sustainability-minded market participants. These indices now serve as the gold standard for sustainability practices. Companies use the DJSI to measure their efforts in a wide range of non-financial indicators against those of their industry peers and competitors. As can be seen from the hundreds of press releases issued by companies, inclusion in the indices is not only a matter of pride, but it also validates their efforts to help solve some of the world’s greatest challenges.

This year brought the introduction of new criteria into the CSA, which serves as the research backbone for the DJSI and a growing number of ESG-focused products jointly offered by RobecoSAM and SPDJI. Criteria like policy influence and impact measurement are on the pulse of what market participants are looking for in terms of forward-looking sustainability indicators. Policy influence, for example, has traditionally been ignored in most sustainability assessments, but it deserves careful attention in terms of the potential reputational risks for companies and investors. This year, RobecoSAM added questions to the CSA related to policy influence to get a better read on whether companies are indeed spending money on influencing policy for positive change, or whether they are in fact putting their money toward discussions that counteract positive change and hinder addressing global challenges, as outlined by the UN Sustainable Development Goals (SDGs).

Through the new questions on impact measurement, RobecoSAM identifies companies that have progressed only past measuring the monetary costs of investments made into environmental technologies or measuring the amount of carbon reduced from their operations, and to gauge the real implications and outcomes of these investments on local communities or human health, for example. Market participants are increasingly looking for a measurable impact to be attached to their investments, and they often start by selecting companies that have begun to think about their impact in a broader sense. The SDGs have given companies, investors, and governments a solid framework to measure their impacts against. RobecoSAM is interested in identifying companies that truly understand that their operations, products, and services can have detrimental and positive impacts on the planet, and that these come with unique risks that need to be managed and opportunities that can be seized.

We recognize that these new CSA criteria pose challenges to companies, and that often, when it comes to policy influence, for example, companies tend to be hesitant to report on spending beyond their legal obligations. With regard to impact measurement, many of the accepted methodologies like the Natural Capital Protocol and Social Capital Protocol are still in their infancy. So, while in many cases company responses to these new CSA criteria were incomplete, a lot of encouraging data was collected, highlighting that companies are moving in the right direction: improved transparency and more strategic action toward achieving the SDGs by 2030.