S&P Dow Jones has been reporting the SPIVA® U.S. Scorecard for 15 years now. Over the years, it has helped contribute to the active versus passive debate in a systematic and objective manner. While some market segments or styles of active management can be cyclical in their ability to outperform, the secular trends in reported long-term SPIVA numbers remain fairly consistent. Beginning with the year-end 2016 report, we have a 15-year comparison, which captures a full market cycle.

There are three key observations we can make from the SPIVA U.S. Year-End 2016 Scorecard: (1) the majority of active managers across major equity and fixed income categories, on average, underperformed their benchmarks over the medium- to long-term horizon, (2) the secular bull market since the 2008 financial crisis has been a difficult hurdle for managers to overcome, and (3) most domestic equity managers failed to navigate effectively during volatile periods in the marketplace (one-year period).

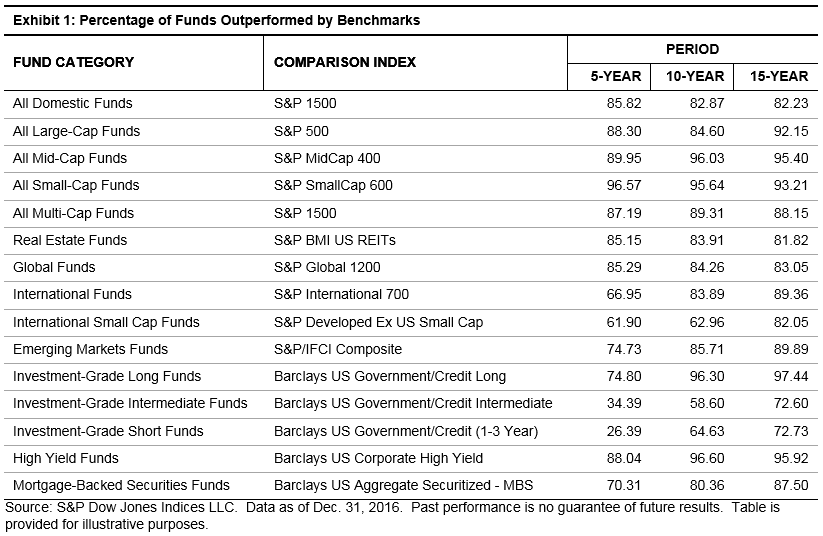

Exhibit 1 addresses the first observation for the various asset classes reported in SPIVA. The scorecard shows that 92.15% of large-cap, 95.40% of mid-cap, and 93.21% of small-cap Funds underperformed their benchmarks, respectively. This lag in performance is a result of approximately 50% of funds surviving the whole period. Market participants seek managers that will outperform, but simply having a fund that will survive may be the first checkpoint.

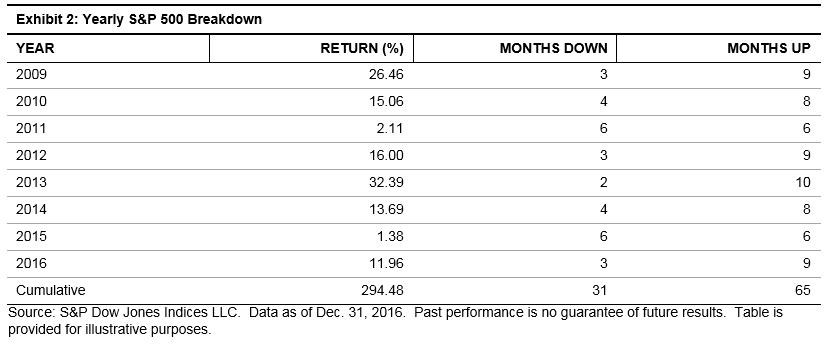

It has also proven difficult for active managers to outperform passive indices during the secular (eight-year) bull market. U.S. equity managers fared marginally better on a percentage basis over the five-year period; nevertheless, the majority of managers still underperformed the benchmark (see Exhibit 1). Exhibit 2 shows the yearly performance of the S&P 500 on a total return basis. Wrong security selection, insufficient market beta exposure, or having a large allocation to cash could possibly result in underperformance, given the strength of the market.

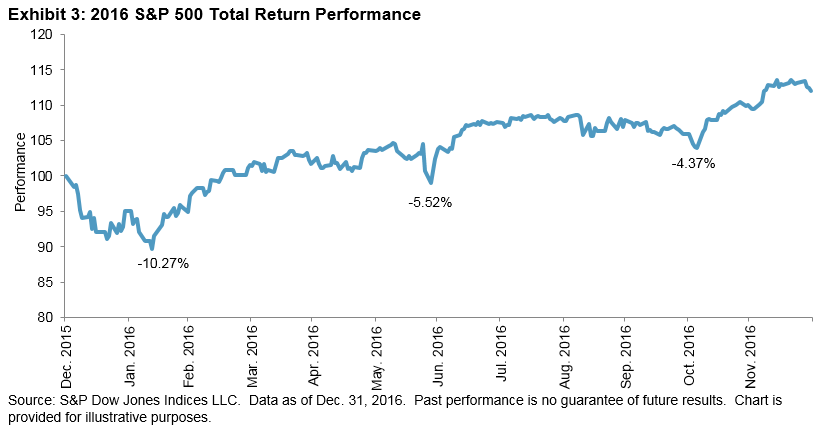

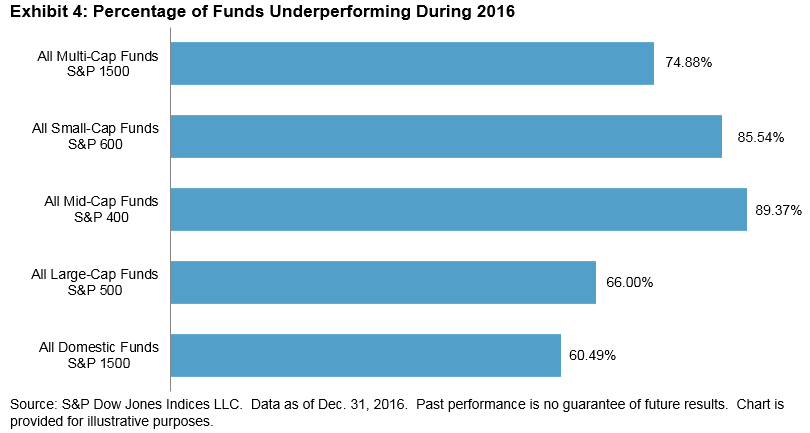

One proposed benefit of active management is that managers have the ability to make tactical asset allocation decisions depending on the market environment, while passive indices cannot do so, as they tend to be structurally constrained by an index rebalancing schedule as laid out in the methodology. The past one-year period encapsulated three market events that could have been the catalyst for such a tactical strategy: China’s economic concerns (Q1), Brexit (Q2), and perhaps a “risk off” environment in anticipation for an uncertain election result (Q4). Exhibit 3 shows the performance of the S&P 500 along with the drawdowns from previous highs for each event. Even amid these market events, 66% of large-cap, 89.37% of mid-cap, and 85.54% of small-cap fund managers underperformed (see Exhibit 4).

The SPIVA Scorecard can act as the starting point for market participants to understand more about the effectiveness of passive investing across major core equity and fixed income categories. The year-end 2016 report in particular is noteworthy in that it addresses key areas of active management: long-term performance, the impact of secular bull markets on managers’ performance, and managers’ ability to navigate market volatility.

Based on the SPIVA findings, core passive indices can potentially be used in the investment process and portfolio construction. To learn more about passively implemented core asset allocation strategies, please join us for our webinar In With the Old and the New: Why Core Strategies Are Still Essential.

The posts on this blog are opinions, not advice. Please read our Disclaimers.