The Dow Jones Sukuk Total Return Index (ex-Reinvestment), which seeks to track USD-denominated, investment-grade sukuk, had a great start in 2017 and rose 1.24% year-to-date (YTD) as of Feb. 10, 2017. A total of 19 sukuk with total outstanding par of USD 15.75 billion were added into the index last year; however, no new sukuk issuances are eligible for inclusion so far this year.

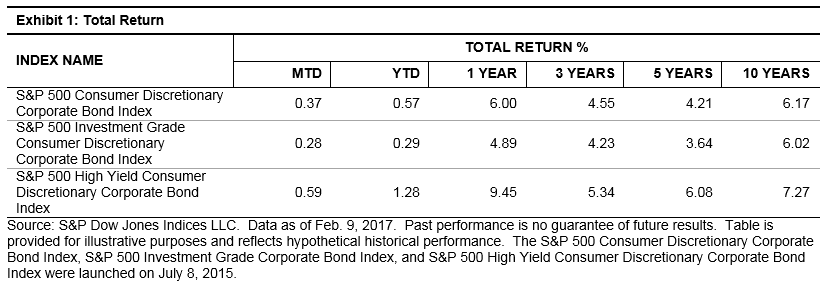

Longer-maturity sukuk continued to outperform among the maturities-based subindices YTD. The Dow Jones Sukuk 7-10 Year Total Return Index rose 2.16% YTD and 6.52% over the one-year period. Similarly, the Dow Jones Sukuk 5-7 Year Total Return Index gained 0.90% YTD and 5.70% over the one-year period. Looking into the historical total return performance, this trend has been consistent in the one-, three-, and five-year timeframes.

Among the ratings-based subindices, the bucket rated ‘BBB’ gained 1.62% YTD, followed by the ‘A’ category, which was up by 1.38% YTD. The biggest exposure in the Dow Jones Sukuk BBB Rated Total Return Index was Indonesia sovereign sukuk, which represents over 40% of the index. The Dow Jones Sukuk AAA Rated Total Return Index was the underperformer in the five-year period.

These performance trends coincided with the sukuk issuance in 2016. According to the Dow Jones Sukuk Total Return Index (ex-Reinvestment), all 19 sukuk added into the index with a tenor of at least five years, six have maturities of 10 years or longer. In addition, 11 out of 19 are ‘BBB’-rated sukuk, while six have a rating of ‘A’ and only two have a rating of ‘AAA’.

Exhibit 1: Total Return Performance of the Dow Jones Sukuk Maturities-Based Subindices

Exhibit 2: Total Return Performance of the Dow Jones Sukuk Ratings-Based Subindices