Walt Whitman said in Song of Myself “Do I contradict myself? Very well, then I contradict myself, I am large, I contain multitudes.” Well, as does The Dow Jones Industrial Average – so I’ll present two contradictory data points from today’s record close.

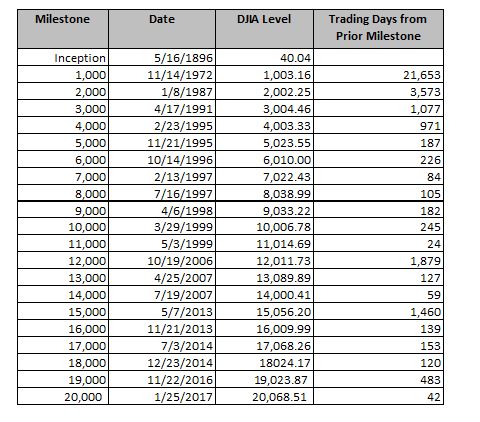

First, the move from 19,000 to 20,000 was quick, happening in just 42 trading days (not calendar days, mind you). This was the second fastest such move since the DJIA first climbed from 10,000 to 11,000 over 24 days in the spring of 1999. The longest was from the DJIA’s May 1896 inception to the first 1,000 point level; that run took over 76 years.

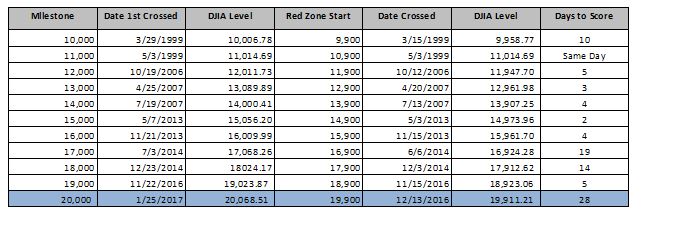

On the other hand, the DJIA took its sweet time meandering through those last 100 points. As I wrote recently in The Red Zone, the march from 19,900 to 20,000 had already taken more trading sessions than the 10 prior milestones. In the end, it took 28 trading days to cover that ground.

Much will be written this week about this first ever close above 20,000. One of the more common debates is the tug of war between the “psychologically important achievement” and “arbitrary milestone” camps. I’ll leave the smart people on both sides of the divide to continue to wage that battle. What I will assert, though, is that no other measure provides us with so much history on which to conduct that battle. With 120+ years of performance – through expansion, recession, depression, peace-time and war – the DJIA remains an ever-reliable indicator of investor sentiment.

Finally, in transparency the Whitman quote wasn’t the first “contradictory” reference that occurred to me. Instead, it was this rather less literate doctor’s office scene from Fletch (1985), which I’ll submit here simply because I doubt I’ll ever have any other reason to use it…

Dr. Joseph Dolan: You know, it’s a shame about Ed.

Fletch: Oh, it was. Yeah, it was really a shame. To go so suddenly like that.

Dr. Joseph Dolan: He was dying for years.

Fletch: Sure, but… the end was very… very sudden.

Dr. Joseph Dolan: He was in intensive care for eight weeks.

Fletch: Yeah, but I mean the very end, when he actually died. That was extremely sudden.