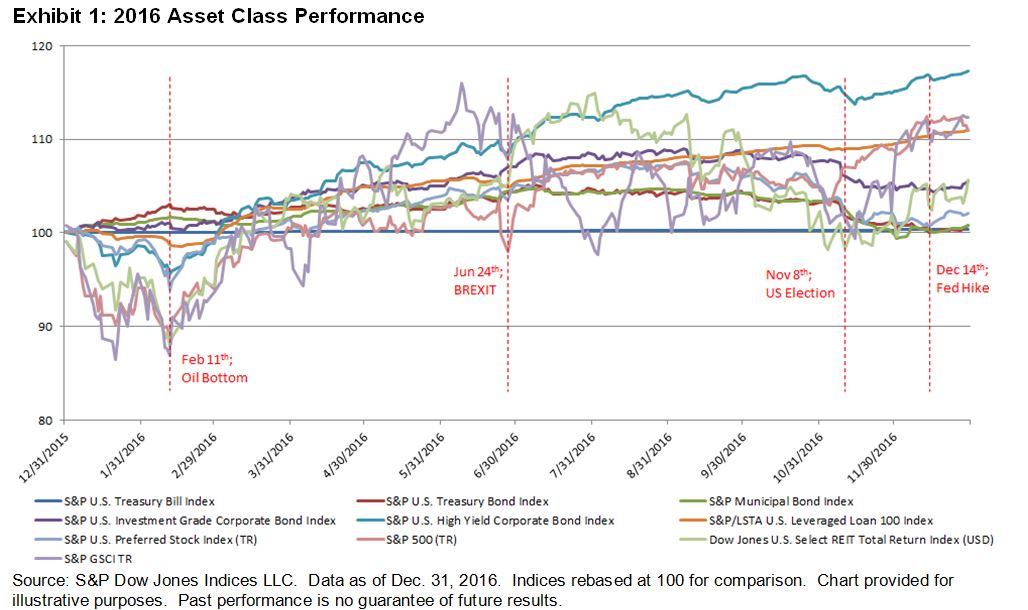

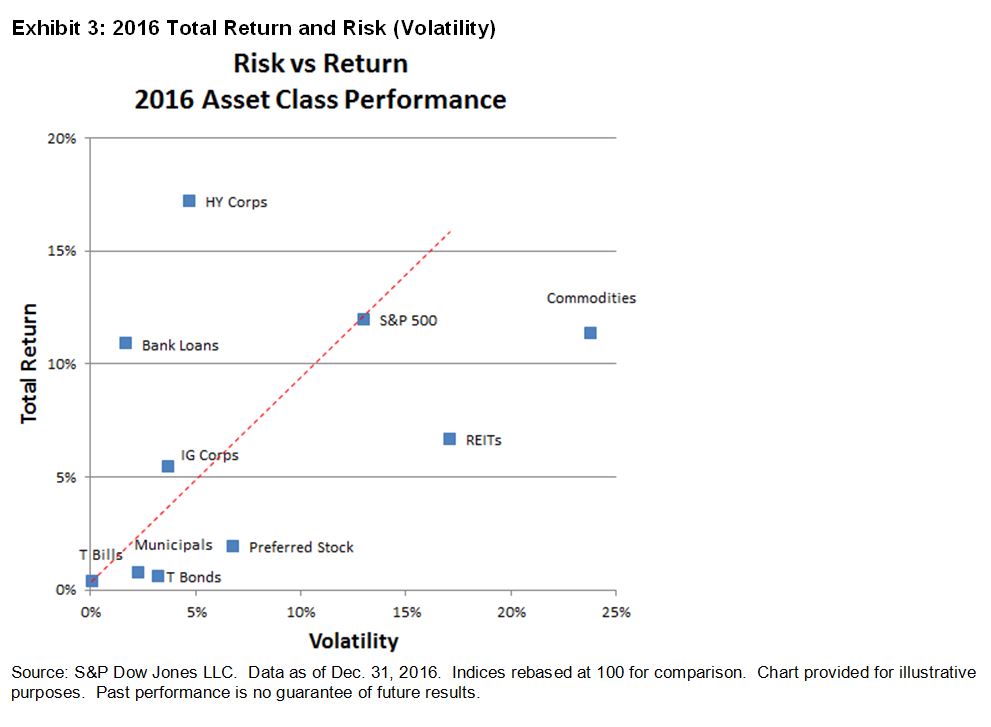

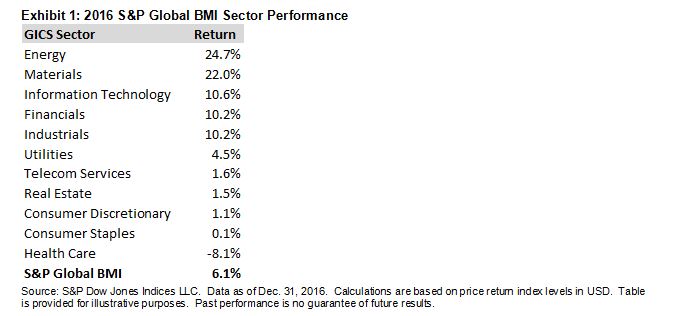

In 2017 politics, not economics will be the major source of market uncertainty. The world’s major economies moved past the financial crisis and Great Recession: unemployment rates are at more acceptable levels and central banks are discussing the end of quantitative easing. Equity markets in the US and the UK made new all-time highs while those in Europe, Japan and Australia are well above their lows. Yields on ten-year treasuries are rising in the same countries. Inflation remains low and deflation worries have faded away.

Just when investors thought they could look forward to less complicated times, politics re-appeared with Brexit, oil, the new administration in Washington and elections in France and Germany. Politics is the focus now. Many investors follow economic calendars for events like the employment report on the first Friday of each month. A political calendar may be useful as well — a few likely events are cited below. By late this year uncertainty won’t be erased but some direction might be visible.

Shortly after the January 20th presidential inauguration we are likely to see proposals and bills appear on Capitol Hill with details on tax cuts and spending increases. These will be closely watched but will contain little real information for investors until they are close to being enacted. Every president since Franklin Roosevelt made promises about the first 100 days – and only Roosevelt in 1932 achieved much in his first 100 days. If either tax cuts or infrastructure spending are enacted before Brexit’s article 50 is invoked, it will show unexpected speed.

Brexit came on the scene last June with the British vote to leave the EU. Recent remarks by British Prime Minister Theresa May suggest a “hard Brexit” with very limited migration allowed between the UK and EU and a need for several new trade agreements. The first step is to invoke Article 50 to start the clock running on two years of negotiations on new rules of engagement between Britain and Europe. Article 50 is promised by the end of March but few expect everything to be settled in two years. For markets, some clarity may be found when both sides explain what they want. As talks drag on there could be periodic swings in the pound and euro against each other and the dollar.

Elections in 2017 in France and Germany will also be closely watched. In France Election Day is April 23rd with a run-off on May 17th. One question is whether the populist anti-elite pattern seen in Brexit and Donald Trump’s US victory will carry over to France. Any sign of populist or nationalist gains could reverberate through markets in Europe and the US. The German election in the fall may be a larger test of populism because Angela Merkel will be running for re-election. Germany’s election must be held between August 27th and October 22nd 2017; a September date is likely.

Politics and oil often mix. The recent agreement among OPEC to reduce output, which boosted oil prices over $50 per barrel, was built on political agreements within OPEC and outside with Russia and other producers. The cuts took effect on January 1st and are planned to last for six months. With the rig count in the US and Canada already creeping up, the oil markets may look different in June.

Just because politics is the source of uncertainty investors shouldn’t forget the fundamentals of earnings, inflation and growth – they’re what matters in the long run.

The posts on this blog are opinions, not advice. Please read our Disclaimers.