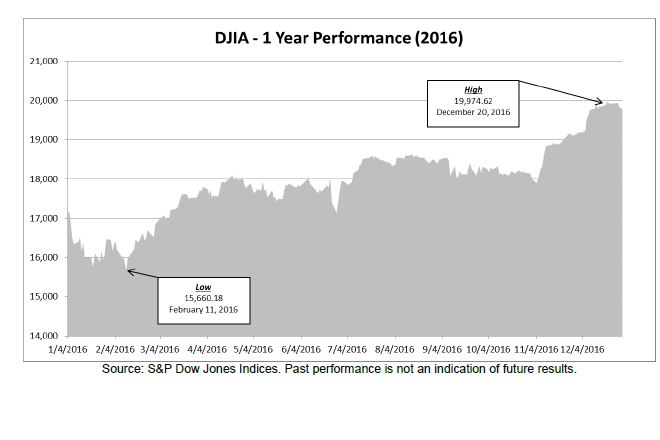

The Dow Jones Industrial Average ended 2016 at 19,762.60 – up 2.337.57 points for a 13.42% annual return, the best year since 2013 when the market surged over 26%.

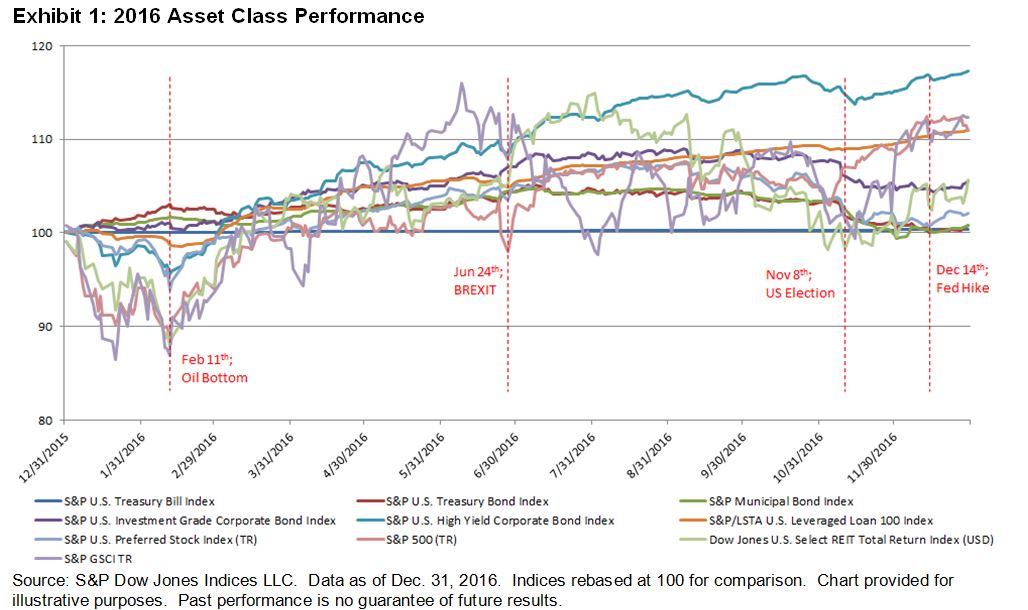

- Biggest Themes – markets were driven by the crash (and partial recovery) in oil prices, Fed-watching, China, Brexit and questions regarding the US economy. Oh yeah, there was a Presidential Election too – it was so under-reported I almost forgot to mention it.

- Leader & Laggard – Goldman Sachs (GS) contributed the most to the DJIA’s advance during the year; Nike (NKE) was the biggest detractor.

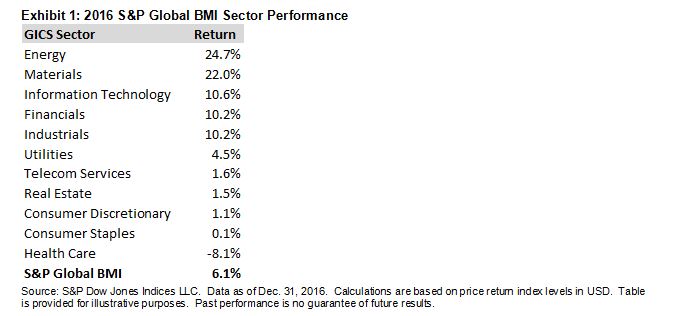

- Sector Performance – Financials were the best performing sector during 2016; the Consumer Discretionary sector posted the worst performance.

- Best Day YTD (In Points & Percent) – January 29th, an otherwise bright spot in a rather tough month.

- Worst Day YTD (In Points & Percent) – June 24th, when the UK votes for Brexit.

- New Highs – the DJIA posted 26 new highs in 2016, including two separate streaks of 7 straight records in July and December.